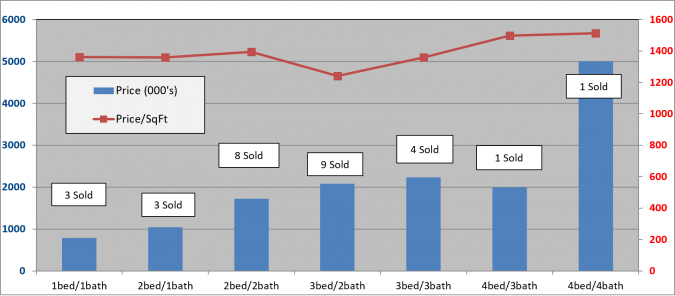

Twelve single family homes sold in the Old Town Key West area in March bringing the total of sales for Q1 2024 to 35 homes sold, or 22% less than the 5-year (2019-2023) average number of Q1 sales of 45. Jan-Mar 2024 each had double digit sales, the first such double/triple since Feb-Apr 2023. Thirty-five sales is more in line with Q1 2016-2020 sales pre-Covid than the frothy sales of Q1 2021 (71) and Q1 2022 (53). On Prices, the average Sold price for the quarter of $2.02M was the 4th quarter in a row over $2M. The average Sold price per square foot for the 35 sales was $1288, in line with the year end of 2023 and 10% higher than year end 2022.

________________________________________________________________________________________

The below charts show sales of the seven most popular bed/bath combinations in Old Town Key West from January 1, 2015 to March 31, 2024. When there is a difference between total home sales and the sum of sales in the below seven charts it is because of a sale of, for instance, a 2bed/3bath or 3bed/1bath house or a house with more than four bedrooms.

These charts are for single family homes sold south and west of White St. and cover the six neighborhoods of The Meadows, Old Town North and South, Bahama Village, Truman Annex and Casa Marina but not Sunset Key. You can view a map of the six neighborhoods of Old Town here. An analysis of the number of sales and sale prices for each of these six neighborhoods for the full year of 2023 is here.

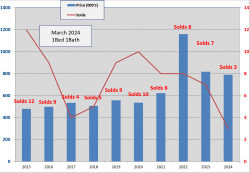

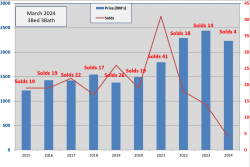

1 Bedroom/1 Bathroom

- Three, 1Bed/1Bath homes have sold in the Old Town area thru 3/31/2024. The number of days on market was 94 days. For all 2023, seven homes sold at an average number of days to sell of 24 days.

- The average Sold price for the three 2024 sales is $790K which is down 3% from 2023 yet 305% above the 2011 low. In 2023, seven homes sold at an average sale price for of $817K.

- There are three 1/1's for sale priced between $699K and $999K.

- The 2024 sales have an average of 580 sqft at an average of $1362 per sqft. In 2023, the average size was 603 sq.ft. and the average sold price per sqft. was $1356.

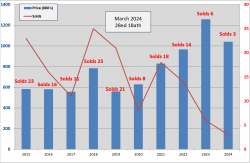

2 Bedroom/1 Bathroom

- Three, 2Bed/1Bath homes have sold in the Old Town area thru 3/31/2024 at an average of 112 days to sell. For all 2023, six homes sold at an average of 88 days to sell.

- The 2024 average sold price of $1.041M is down 17% from 2023 and 214% above the 2011 low.

- The 2024 average sold price per square foot of $1359 is up 9% over 2023 and is the highest ever.

- There are five 2/1's for sale priced between $700K and $2.6M

- Since 2009, 2Bed/1Bath homes have been the 3rd most popular selling home in Old Town with 252 sales

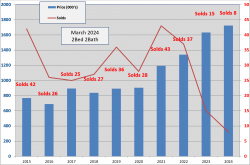

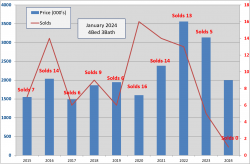

2 Bedroom/2 Bathroom

- Eight, 2Bed/2Bath homes have sold in the Old Town area thru 3/31/2024 at an average of 66 days on market. For all 2023, fifteen homes sold at an average of 46 days to sell. Fifteen sales was the fewest since 2008.

- The 2024 average Sold price of $1.723M is up5% over 2023 and 305% above the low in 2009.

- Fifteen 2/2's are for sale, priced between $850K and $2.3M.

- The 2024 average Sold price per sqft of $1394 is up 8% over 2023.

- Since 2009, 2Bed/2Bath homes have been the biggest sellers in Old Town Key West with 452 sold.

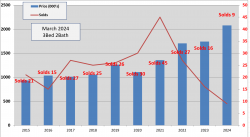

3 Bedroom/2 Bathroom

- Nine, 3Bed/2Bath homes have sold in the Old Town area thru 3/31/2024. The average number of Days to sell is 54 Days.

- The average Sold price of $2.078M is up 19% over 2023 and is 351% above the 2009 low.

- The average sold price per sqft. is $1241, up 8% over 2023.

- Sixteen 3/2 homes sold in 2023, fewest since 2016.

- Since 2009, 3Bed/2Bath homes have been the 2nd biggest sellers in Old Town, routinely exceeding 20 sales annually. Total sales since 2009 is 358 sales.

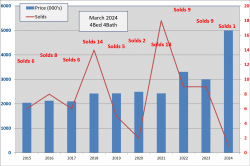

3 Bedroom/3 Bathroom

- Four, 3Bed/3Bath homes have sold in the Old Town area thru 3/31/2024. The average number of days on market was 4 Days! For all 2023, 14 homes sold at an average of 110 Days.

- The 2024 average sold price is $2.231M, down 9% from 2023 and 202% above the 2010 low.

- The 2024 average Sold price per sqft. is $1359, down 5% from 2023.

- Fourteen homes sold in 2023, fewest since 2011.

- Since 2009, 3Bed/3Bath homes have been the fourth biggest seller in Old Town Key West with 295 sales

4 Bedroom/3 Bathroom

- One, 4bed/3bath home has sold in the Old Town area thru 3/31/2024. For all 2023, 5 homes sold at an average of 40 days to sell. In 2022, 13 homes sold at an average of 66 days to sell.

- The 2024 sold price of $2.0M is down 36% from 2023 and is 271% above the 2009 low.

- The 2024 sold price per sq.ft. of $1497 is down 32% from 2023. 2023 ended with the highest ever average sale price per sqft of $2210.

- There are eleven 4/3 homes for sale priced between $2.3M and $5.6M

4 Bedroom/4 Bathroom

- One, 4Bed/4Bath home has sold in the Old Town area thru 3/31/2024. For all 2023, nine homes sold at an average of 39 days to sell. In 2022, nine homes sold at an average 49 days.

- The 2024 sold price of $5M is up 66% over 2023 and is up 349% over the 2009 low. The 2024 sold price per sq.ft. of $1538 is up 38% over 2023.

- Since 2003, the average number of annual sales is six, with nine in 2022, eighteen in 2021 and two in 2020.

- Despite the choppy number of sales, price action has steadily climbed from $2.M in 2015 to $3M in 2023.

Conclusion

Sellers are holding on to their prices as Profits trump Market Share. Sales for the Quarter:

- Under $500K - 0

- $500K - $800K - 3

- $800K - $1M - 1

- $1M - $1.5M - 11

- $1.5M - $2M - 6

- $2M - $2.5M - 2

- $2.5M - $3M - 4

- Over $3M - 8

- Total - 35

Cash sales hit a record 80% for the Quarter, fueled largely by upbeat S&P 500 and Dow markets. Investors see hotel room occupancy rates averaging 88%, average daily room rates above $493 and record airport and ferry terminal arrivals and know full well that short term vacation rentals will generate cash flow whenever it suits them.

City Hall and its supporters steadily prioritize the golden tourist goose and the enormous tax revenues it lays as the best strategy for the Key West. Real estate sales may have come off their post-Covid gush but until some external force causes otherwise, residential and commercial sales with a focus on tourism will move steadily albeit cautiously forward.

Summary 2015 - 2024