When the Tax Cut and Jobs Act (TCJA) was implemented, one of the more talked about components affecting real estate was the cap on Mortgage Interest Deductions (MID). Namely, would the new cap of $750,000 negatively effect the sales and resales of high end residential real estate? Would the "wealthy" stop buying and selling because they were no longer able to deduct more than $750,000 of mortgage interest and if so, how would this drop in transactions affect those areas where expensive real estate dominated? Let's take a look at Old Town Key West.

Mortgage Interest Deduction

The Tax Cut and Jobs Act limited the Mortgage Interest Deduction (MID) on the first $750,000 of primary residence mortgage debt (reduced from $1M of mortgage debt) for mortgage loans taken out after December 15, 2017. In addition, homeowners could only deduct interest paid on home equity loans if the loan is used to buy, build, or substantially improve the taxpayer’s home that secures the loan.

Mortgage interest is no longer deductible on a new second home at all -- even if you are well under the $750,000 limit on your primary home. If though you had a second home mortgage from before December 2017, that mortgage interest can still be deducted. The ban on deducting interest on a mortgage for a vacation home affects only new purchases, so if you already have a vacation home, you may want to hang onto it.

Taxpayers can deduct state and local real estate, personal property, and either income or sales taxes in 2018, to a maximum deduction of $10,000.

PS - If your questions are more complicated than "Which way is Up?" I strongly recommend you talk to a Tax specialist because everyone's case is "unique".

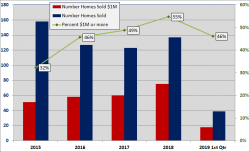

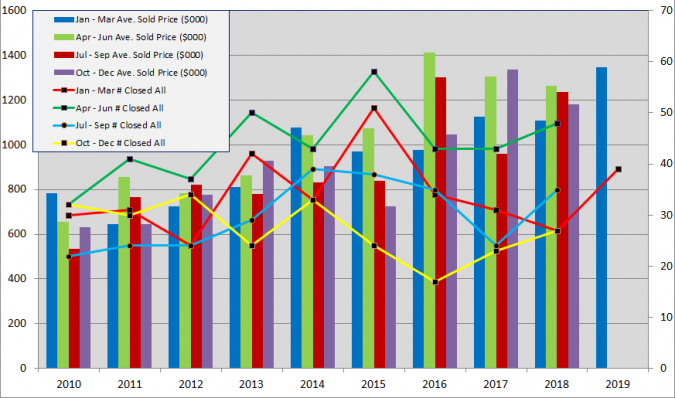

Old Town single family home sales peaked in 2015 but fell in 2016 to 127 sales and in 2017 to 123 sales. 2018 started slow but rebounded nicely for each of the 2nd, 3rd and 4th Quarters, finishing with 137 sales. Sales prices throughout this 2015 - 2018 period marched upward in both average sales price and in average sales price per square foot. See the End of Year 2018 Annual Report.

1st Qtr 2019 Old Town home sales were excellent, up 44% over (a soft) 1st Qtr 2018. The 1st Qtr 2019 average sales price topped $1M for the eleventh quarter since Jan - March 2016.

What of these $1M+ homes?

$1M and Above

There has been no shortage of $Million dollar buyers and sellers in Old Town. 2018 was a banner year for the purchase of primary, secondary and investment homes in Old Town. Fully 55% of the 137 Old Town homes bought and sold in 2018, or 75 single family homes, topped the million dollar mark.

Of the 75 homes that sold in 2018 for more than $1M, 57%, or 43 homes, sold for cash. This is a significant percentile. Since 2015, cash sales for all single family homes sold in Old Town have average 57%, well above the national average of cash sales of 25%. So why the big preference for cash sales?

Cash vs. Mortgage

In April 2019 the 30 year Jumbo mortgage interest rate was 4.19%. In 2015 the 30 year Jumbo rate was 3.84%. A 9% jump in 5 years. This jump even as a proactive Federal Reserve has lowered traditional 30 year mortgages from 4.95% in November 2018 to 4.29% in April 2019.

In April 2019 the S&P 500 hit 2933. In April 2015 the S&P 500 stood at 2085. A 41% jump in 5 years.

In the 1st Qtr of 2019 the average sales price for a single family home in Old Town Key West was $1,346,000. In the 1st Qtr of 2015 that same average sales price was $970,000. A jump of 39%.

Affluent buyers are converting their market positions into cash and cash into equity - predominantly 2nd home equity, from which many derive healthy vacation rental income and still use the home for their personal use for months per year.

Note: Property tax depends on its Assessed Value by Monroe County, a figure usually 12% - 15% below the Free Market Value. The estimated property tax on a home with a Free Market Value of $1,346,000 is $9800. Florida has no state income tax.

Conclusion

Impact of the TCJA and a cap reducing MID and taxes on Key West real estate -

- Have sellers of high end homes lowered their sales price to compensate for the loss in mortgage interest deduction - No.

- Has the turnover of high end homes lessened - No.

- Is it taking longer for high end homes to sell - No.

- Have property taxes been adjusted downward in order to fit under the $10,000 cap - No.

How come no ill effects from the lowered cap on MID? Look at the Big picture.

The TCJA lowered individual income and corporate tax rates. Taxes were also lowered for America’s small businesses. The American economy is solid and net worth is on the rise. Wages and wealth are growing. Americans have purchasing power and those with high income/wealth are broadening their overall portfolios by expanding in to the high end real estate market.

If you have any coments or questions, please contact me here.

Good luck!

Additional Resources: