Building related stocks as a group are outperforming the market. Here’s a selection of broad-based stocks reaping benefits from improving housing conditions.

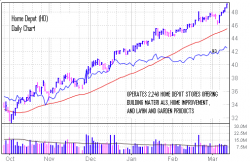

Home Depot (HD) is the world’s largest home improvement chain. “…Home Depot will reap rewards from an accelerated focus on customer service,” wrote S&P analyst Michael Souers in research report. Part of this is that aging homes and low interest rates should boost demand for remodeling projects. (Side note – aging automobiles have proven a boon to do-it-yourself auto parts companies like Advanced Auto Parts, Autozone, O’Reilly Automotive and Monroe Muffler.)

After four years of decline, HD profit climbed 25% in fiscal 2011. Full-year fiscal 2012 profit is forecasted for $2.38 per share, almost 15% over 2011 per share profit. HD has paid dividends for 25 years with a quarterly rate of 29 cents per share or a yield of 2.6%.

Fastenal (FAST) manufactures fasteners, nuts, bolts and studs and derives some of its strength from nonresidential construction, says Michael Jaffe, analyst for S&P Capital IQ. As with HD, increases is renovations; kitchens, bathrooms, cabinetry, etc. , are going to FAST’s bottom line.

W.W. Grainger (GWW) set an all-time high in January 2012. GWW distributes tools, lighting, plumbing and other maintenance products. For 2011 GWW grew earnings per share by 33%, which were back to back double digit increases in annual revenue. GWW has raised its dividend for 40 consecutive years with the dividend nearly doubling since 2007 to a present 66 cents per share.

Paint maker Sherwin Williams (SHW) and maker of paints, coatings and special polymers Valspar (VAL) have also been on a tear supporting do-it-yourselfers and new home builders seeing a rebirth in the new home market. Institutions own 75% of VAL common stock. SHW said 4th quarter earnings per share increased 18% on increasing sales in finishes and its exposure in Latin America.

Given the enormous downturn in new home construction, the strength shown by these firms is incredible and in large part because you and I have decided to fix our own homes or hire small owner/operator businesses like those that sprinkle Key West to renovate and repair.

Last year was the weakest year for single-family home construction ever. Ever. Sales of new homes were at their lowest for the past 50 years. People bought cheap, foreclosures or stayed put. This set of factors pointed to renovations and repairs and the profits of the above companies.

National Association of Home Builders Chief Economist David Crowe forecasts builders to initiate construction on almost 500,000 single family homes in 2012 and 660,000 in 2013.

U.S. home builders surged on Friday after Daniel Oppenheim, an analyst for Credit Suisse analyst upgraded three stocks to Outperform; DR Horton (DHI), Lennar Corp (LEN) and Toll Brothers (TOL), citing improved order prospects as real estate agents report higher interest from potential home buyers.

Oppenheim expects orders for the home builder stocks he covers to rise 18 percent this year, and 19 percent in 2013. The foremost risk is that a greater number of foreclosed homes are expected to reach the market in the wake of a recent national agreement between regulators and major lenders over mortgage foreclosure practices.

Both DHI and LEN build single family homes for first-time home buyers and those moving up in class. TOL builds single family homes in luxury communities for move up and empty nester buyers.

Lennar is based in Florida. The stock is up 19% this year and is trading just below a four-year high. DHI is based in Fort Worthh, TX and is the largest home builder in the US by number of units closed since 2002. Toll Brothers, based in Pennsylvania, is known for its higher-end homes as well as age-qualified communities. The stock is up 15% in 2012 and it is trading just below a multi-year high.

If you have any comments, please contact me here.

Additional Resources: