Whether building new or fixing up what’s already there, home improvement stocks have weathered reasonably well the real estate decline. Budget conscious property owners know there’s plenty bang for the buck in new roofs (lower insurance rates), paint and flooring. Energy management such as backup power generators are top features according to the American Institute of Architects. Unless you’re a home improvement junkie and weekend trips to your local hardware super store top your Trip Advisor watch list, companies providing these tools are not often household names.

Here's a few investment grade companies that are helping your home shine.

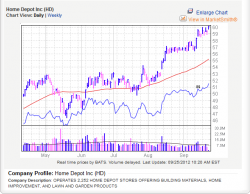

Home Depot (HD) and Lowes Companies (LOW) are the two 800 lb gorillas vying for top dog in the big box category. Both specialize in inventory management and broad-based customer service. The HD in my town competes strongly with the small guy to install rugs, appliances and remodel kitchens and baths, etc. Wisely, HD uses local craftsmen for these jobs so the money stays local. (Still though I often use local entrepreneurs for specialty work).

HD presently tops LOW in earnings as HD's EPS sits at 17% versus LOW at -4%. HD also wins in 3 yr growth and profit margin at 21% and 8.6% over LOW at 15% and 6.7%. HD carries more Debt, 60%, then LOW at 43%, but with 500 more stores then LOW, HD seems prepared to service that drag.

Enough of the Big Guys - Let's look at some specialty shops

Beacon Roofing Supply (BECN) distributes roofing and related building materials through 208 branches in 38 states and 6 Canadian provinces serving key metropolitan markets in the Northeast, Mid-Atlantic, Southeast and Southwest regions of the United States and in Eastern Canada. The Peabody, MA based company went public in September 2004.

BECN provides an extensive array of residential and commercial roofing products; metal, shingles, slate and tile as well as lumber, waterproofing, insulation and air barrier systems. Topping the roofing options are:

- High-end residential copper gutters and downspouts;

- Drip edge, flashing, and other metal details for commercial roofing systems in a choice of metals and colors; and

- Complete metal roof systems with several profiles for commercial and residential applications manufactured in the shop or roll-formed on site to minimize waste and assure a tight fit.

BECN has teamed up with the Valspar Corporation to create the COLOR-LOC™ paint system which assures your roofing looks as good as it works.

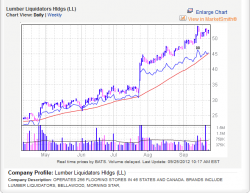

Lumber Liquidators (LL) operates 256 flooring stores in 46 states and Canada under the brands Lumber Liquidators, Bellawood and Morning Star.

Australian Cypress, multiple choices of Brazilian cherry, rosewood and walnut, mahogany, bamboo and cork plus a wide array of engineered hardwoods, laminates and vinyls make LL the place to go for flooring supplies and installation. Your wood flooring can come finished or prefinished in your choice of coating.

LL uses woods from managed forests. Foresters, forests, wildlife and consumers benefit from the wise use of natural wood resources. Cork and bamboo flooring provide an enviromentally sound choice as both options optimize forest growth and productivity.

Generac Holdings Inc. (GNRC) manufactures standby power generators and components for residential, industrial and commercial markets. Generators are sold under the Generac and Magnum brand names. Power generators provide from 6KW to 60KW of continuous power using LP or natural gas. Generac designs engines for this specific purpose, increasing engine life, reducing noise and life cycle costs.

GNRC is based in Waukesha, WI, began operations in 1959 and has over 4400 residential and commercial dealers. GNRC boasts a 3 year EPS growth rate of 52% and a profit margin of 18%. GNRC carries a P-E ratio of 8 though its Debt is 75%.

In North America GNRC calculates a 17% compound annual growth rate for home standby power generation. GNRC has 70% of that growth. With the aging US power grid GNRC estimates continued expansion. This is backed up by the American Institute for Architects which lists standby power generators as one the highest demanded items for new and rebuilt construction.

Remember, not a lot of prospecters got rich at Sutter's mill,

But a bunch of well managed pick and shovel stores did. Maybe these real estate oriented stocks are worth your look.