Sixty-two percent of Americans are home owners. For most of us, home ownership is our largest and only investment in real estate. What about other investment options; such as, residential or commercial investment property, Real Estate Investment Trusts (REITs) and the publicly traded stocks of home builders, suppliers and remodelers. Residential real estate contributes 17 - 18% of the GDP for the United States. Here are a few stock ideas to broaden your investment portfolio; a countertop manufacturer from Israel, rugs from Tennessee, metering systems for electricity and water from Washington, a giant home builder from Miami and storm resistant windows and doors from Venice, FL.

Home Buying vs. Home Remodeling

Housing contributes to GDP in two basic ways: through private residential investment and consumption spending on housing services. Historically, residential investment has averaged roughly 5% of GDP while housing (remodeling) services have averaged between 12% and 13%, for a combined 17% to 18% of GDP.

You can see how remodelers, from Lowe's (LOW) to Lumber Liquidators (LL), contribute powerful numbers to GDP and home owners equity/value. Lets take a quick look at a handful of companies.

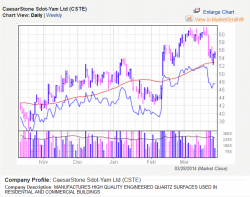

Quartz countertops from Israel

Israel-based Ceasarstone (CSTE) manufactures high quality surfaces for kitchens, bathrooms and other custom furnishings. For more than a decade, the company has made innovations, such as the use of quartz in its manufacturing process, to provide improved products with physical properties said to be superior to those of marble, granite and other manufactured surfaces.

CSTE sells engineered quartz surfaces under the Caesarstone brand primarily in Australia, the United States, Canada, and Israel. A $100M manufacturing plant is expected to open in Richmond Hill, GA the first half 2015.

CSTE has an 3 year Earnings per Share growth average of 29%. The 2014 forecast is 22%. With a market cap of $2B CSTE has a debt to equity ratio of 6%, excellent. CSTE recently traded at an all-time high.

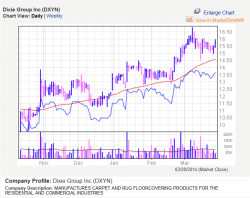

Luxury carpets and floor coverings from Tennessee

The Dixie Group (DXYN) is a marketer and manufacturer of luxurious carpet and rugs to high-end residential, retailing and luxury yachts through the Fabrica International, Masland Residential and Dixie Home brands. High-end carpet and rugs for commercial applications are marketed by Masland Contract. Dixie Group is home-based in Chattanooga, TN.

For DXYN's fourth quarter operating results, sales jumped 34.7% year-over-year to $95.8 million--highest level since the company’s reconfiguration in 2003. The company recorded growth in all areas of the business, with residential products up 30.5% and commercial products up more than 45%. During FY 2013, 58% of the sales were derived from the residential market, while 42% were from the commercial market.

Since June 2013, DXYN has acquired two leading brands in Robertex (wool floorcoverings) and Atlas Carpet Mills (high-end commercial floor covering).

Hi-tech metering systems for energy consumption from Washington.

Itron (ITRI) develops next-generation intelligent metering, system and service solutions to optimize revenue generation, resource management, and customer engagement for electricity, natural gas, water, solar and thermal systems. ITRI is headquartered in Liberty Lake, WA with 8000 customers in 100 countries on six continents.

ITRI gapped down 15% on February 13th due to disappointing 2013 earnings per share of $1.90 versus anticipated $2.29 on flat annual revenue. Guidance for 2014 too was less than analysts predications (why are analysts always considered correct?)

However, cash flow, debt levels and product and market diversification remain upbeat pointing to a positive, albeit risky near term future.

Another company within the same field to consider is Ametek (AME). AME makes electric motors, power meters and other goods for aerospace, defense and industrial markets and recently reported higher fourth-quarter profits. AME is not as much of a real estate play as ITRI.

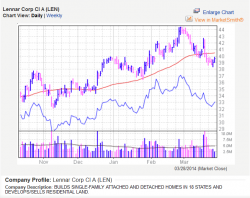

Single family home builders

Miami, FL based Lennar (LEN) is the 500 lb. gorilla in the home builder category. LEN builds affordable, move-up and retirement homes. Lennar's Financial Services segment provides mortgage financing, title insurance and closing services for both buyers of the Company's homes and others.

Lennar logged earnings of 35 cents a share for its fiscal first quarter, ended in February. That was vs. 26 cents a year earlier and 7 cents over consensus views. Revenue rose 37% to $1.36 billion, atop estimates for $1.28 billion. Lennar delivered 3,609 homes in Q1, a 13% year-over-year gain.

For 2013, LEN saw a 17% increase in average sales price ($316,000) and new orders rose 10% to 4,465 homes. The average price of these backlogged homes in $342,315.

As a comparison, luxury home maker Toll Bros.,TOL, expects to deliver between 5,100 to 6,100 homes in 2014 at an average price of $670,000 to $720,000. All numbers were up in 2013 with 2014 profit expected to rise 66% and in 2015, 40%.

Homes are selling best in the South and West states, the result of population movement and better weather. Of the 18 states where LEN builds, all are in these areas except MA, NJ, MD, DE and MN.

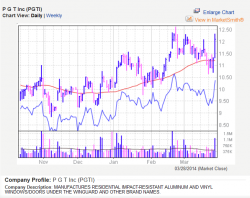

Energy and storm resistant windows and doors from Florida.

PGT Industries (PGTI) pioneered the U.S. impact-resistant window and door industry and is the nation's leading manufacturer and supplier of residential impact-resistant windows and doors. Homebased in Venice, FL, PGTI sells it products and services throughout the eastern US, the Gulf Coast, the Caribbean, South America and Australia.

Over the last three quarters, average earnings per share growth has been 120%. Annual return on equity is a robust 37% but PGTI carries a high debt to equity ratio of 147%. Fourth quarter gross profit rose 28.8% to $20.6 million from the year-ago quarter, driven by strong revenue growth. However, gross margin contracted 220 basis points (bps) year over year to 33% due to an increase in labor and material costs. For 2013, PGTI reported adjusted earnings per share of 44 cents, marking an improvement of 175% from 16 cents in 2012.

Of note, PGTI has a strong buyback program, having bought back at least 5% of its outstanding shares over the past twelve months. Often times if the company itself believes the stock is a good value, the stock should do well in the future

Conclusion

So there you have it, some interesting stocks wrapped around the improving residential real estate market. It is recognized that the improving market is causing material and labor costs to rise. The question is whether or not overall confidence in the economy and more and better paying jobs will keep home sales and remodeling on the upswing.

If you have any comments or questions, please contact me here.

Good luck!

Additional resources: