On October 01, 2013 the Flood insurance on your “non-primary residence” is going up 25%. Businesses too. Not, maybe up to 25% but increasing a full, flat 25%. In 2014 another 25% and thereafter more increases until the National Food Insurance Program (NFIP) is solvent and can repay itself for the floods of Hurricane Katrina, Superstorm Sandy, river floods throughout the US and have cash on hand to pay off all other floods thereafter. The cheap, nationalized, NFIP is no more. Foolishly building and rebuilding homes in flood zones is no more. We can do little about it How is Rep. Joe Garcia helping us?

A recap of how we got here.

Back in January I wrote a Flood Insurance blog about the Biggert-Waters Flood Insurance Reform Act of 2012 (BW12), pending increases in flood insurance and the background of the legislation that is bringing these rate increases. Only recently have those who sponsored and voted for the bill acknowledged the tragic depths of the "unintended consequences" that their economically well meaning but poorly understood human-impact actions would pass on to property owners and the real estate industry.

In response to the outcry from voters and professional groups, as of June 2013, a total of seven pieces of legislation have been introduced in the U.S. House of Representives and the U.S. Senate to delay the phasing in of higher flood insurancerates as required by BW-12. Yet, no meaningful movement so far.

What about historic buildings like those in Key West, particularly Old Town?

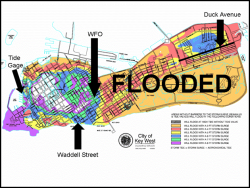

BW 12 makes no special provisions or exceptions for historic buildings. For rating purposes, historic buildings are to be treated the same as any other Pre-FIRM properties; i.e., properties built before 1975. (FIRM is Flood Insurance Rate Map, the most recent being from 2005 and is the one that Key West uses for Flood Zones.)

Any currently subsidized policies for historic buildings meeting the criteria established in Section 100205 of BW12 will see premium rate increases. Those structures will have rate increases at a rate of 25% per year until full actuarial rates are achieved.

These criteria are:

- Non-primary residences

- Business properties

- Severe repetitive loss (SRL) properties

- Properties for which claims payments exceed the fair market value

- Substantially damaged or improved properties (which could mean historic homes approved by HARC for significant renovations)

What if my primary residence is a historic property?

All primary residences – including those that are historic buildings – that were built before the initial Pre-FIRM (1975), and that are located in special flood hazard areas (flood zones A, AE, AH, AO, A1-A30, V, VE, V1-V30) and D zones will see a 16 to 17 % increase effective on or after October 1, 2013. This includes the 5% Reserve Fund assessment.

Whew! I'm in an X-Flood Zone. Not so fast. All policy holders not included in the above zones will receive a minimum 5% Reserve Fund assessment. (I've heard that figure being as high as 17%).

Florida has 40% of flood policies nationwide - But ...

According to a 2011 analysis by the University of Pennsylvania's Wharton Center for Risk Management and Decision Processes, over the past 35 years, Florida property owners have paid $16.1B in premiums while collecting $3.7B in claims.

Contrast that with Louisiana, which paid $4.4B in premiums but collected almost four times that in claims, the vast majority tied to Hurricane Katrina. Katrina pushed the NFIP $18B in debt, causing NFIP to borrow from the federal government.

Since 1978, Texas (contributing $5.5B), New Jersey (contributing $4.8B) and New York (contributing $4.4B) have also received more payouts than Florida. And those numbers predate last year's Superstorm Sandy, which caused billions more in flood damage in the Northeast.

What of our Politicians?

Remember, this Act with enormous implications was inside the giant Transportation Bill of 2012, not hidden, just inside. You couldn't know it wasn't coming.

- Senator Nelson voted in favor.

- Senator Rubio voted to oppose.

- Representative Ros-Lehtinen voted in favor.

On July 26, 2013 Representative Joe Garcia, representing Monroe County, sent a letter to the Administrator of FEMA, Craig Fugate, expressing his deep concerns over the rate increases and asking why a pair of FEMA studies, mandated by BW12, have not been accomplished.

The first study was to educate consumers about BW12 and encourage participation (sort of like "this is going to sting a little bit"). The second study was to educate lawmakers by providing economic impact and affordability analysis (sort of like "we have to pass this bill to understand what's in it").

The letter also refers to two pieces of legislation, one of which Rep. Garcia co-sponsored, that have been introduced to delay or review rate increases.

You can read Representative Garcia's full letter here.

Conclusion

It seems unfair to me to provide decades of subsidized flood insurance rates, only to jam enormous rate increases down the throats of policy holders. Katrina and Sandy brought the fallacy of government subsidies and high risk, under insured coastal properties to the forefront. Is punishing policy holders, in some cases making their homes unaffordable, through BW12 the best our politicians can do?

If you have any comments or questions, please contact me here.

Thank you and Good Luck.

Additional Resources: