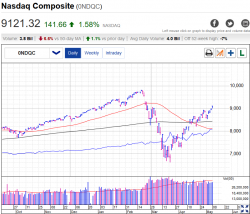

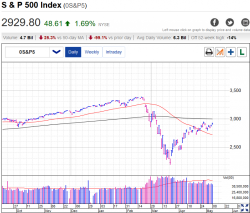

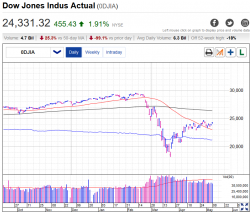

The major markets of the S&P 500, the Dow and the NASDAQ have been steady and ready sources for the purchase and sale of Old Town Key West real estate since 2010. Both cash and mortgage buyers have directly and indirectly used these markets to buy personal and investment property in Key West. When these three markets broke in mid- and late-March, the costly real estate market in Key West could only save money by not spending money. Over extended property owners held their breath. Some'r still blue, even in the face of the dramatic "check mark" rebounds of these markets. When can we exhale?

The Way We Were

There is no doubt of the 5, 10 and 15 year investment worthiness of Old Town Key West real estate. No more is there the go-go, no money down, no income verification, get a second mortgage at Closing to provide your downpayment, period of the early 2000's that facilitated the crash of Key West real estate from late 2005 to winter 2009/2010 - where everything lost 50% of its value.

No more of that flimsiness. The 10-year climb out has been steady and relentless, buying low and selling high, buying high and selling higher. Cash sales have held steady at 51 - 52% per year, double the national average. Low interest rates plus enhanced lending standards have filled in the rest, but not at 3% and 5% down. No, mortgage buyers have routinely plunked down 20% and higher. Old Town real estate is confident, long-term and equity rich. The current crisis is not a structural failure of banking, finance, policy or real estate. It is driven by a single event. Very few property owners are running for the door.

For the 1st Quarter of 2010, thirty homes sold in Old Town Key West at an average sold price of $783,000. For the 1st Quarter 2020, thirty-two homes sold in Old Town at an average sold price of $1,310,000. At the end of 2014, 148 homes had sold at an average sold price per square foot of $608. At the end of 2019, 144 homes had sold at an average sold price per square foot of $819.

OK, so now what?

Where Are We Now

April 2020 Old Town Key West sales had mixed results. Sales of single family homes stumbled, down 35% from the 5-year (2015 - 2019) average. Yet, average sold prices were barely shaken at $1.341M. (2019 finished at an average sold price of $1.285M) Today's 10 Contingent and 3 Pending contracts for sale, plus any walk-ons, likely will not hit the 5-year average of solds in May of 18. OK, just who are the contestants in this rumble?

In this corner - Covid 19. According to the Center for Disease Control and Prevention, SARS killed 10% of its victims, MERS, 33% of its victims and Covid -19, 6% to 7% of its victims. But Covid is a different concoction; more fluid, transmittable, shadowy and not likely to self-burnout. Vaccine 2021? 2022? 2030?

And in this corner - Domestic, large cap, growth stocks led by Tech and Big pharma. Microsoft, Apple, Paypal, Netflix and Eli Lilly have each received over $1B the last three months from the top performing money managers. Institutional investors for mutual funds, pension funds, endowment funds, etc have been pouring money also into Zoom Video, Docusign, Adobe, United Health, Dexcomm, Nvidia, Regeneron, Service Now and more, companies all benefitting from stay at home/work at home.

And finally, the Gorilla. At a projected deficit of $3.7T, Federal stimulus money, coupled with easy Treasury money, can create inflationary pressures. Under such circumstances, real estate is an excellent investment.

When Can We Get Back in the Game

Who buys Old Town Key West real estate?

The people who have the expendible cash or credit worthiness to buy a not-primary residence at $800 per square foot are the same people who were smart enough to dump their old portfolio in March and buy a new one in April. These people have the agility and courage to go into cash, to short the bear and long the bull. Question is, when will these savvy investors turn their attention to Old Town Key West real estate?

First, I don't really know. Second, if there is a re-spike in Covid related illnesses there is a strong argument stating the markets as they presently exist will probably get stronger. Companies currently profitting would solidify their positions, buy or co-op tangential companies and initiate a hiring process to create a neo-economy. If there is no re-spike in Covid, the markets would probably decelerate their incline, broaden their base of advancing companies and proceed ahead with leadership of both new and old re-engineered.

But when can we know to start to exhale? We will know when the first offers start to trickle in. The first risk takers, like fishermen who set out as swells lower to 10', cause you never know what's biting. Then more offers and with each passing wave the Offer Price:List Price ratio will shrink until we're back in biz. 3rd Qtr 2020.

Can We Get There

Key West is a tourist town with enormous demographic gaps between landlords of commercial and residential property and those tourism-based workers who rent from them. Covid has forced landlords, for the first time in a long time, to reset their control of high and higher rents. Which landlord will lead in slashing rents? Will anyone follow and continue to follow? Hint: The Law of Influence. Some civic/business owners are attempting to craft a consensus to redesign Key West's economy away from the tourist dependency. Sitting back, the status quo beckons. Can Key West at least get a face lift? .

Meanwhile, as Main St. Key West/USA wrestles with itself, Wall St. proves the leadership, agility and ingenuity of a united private sector can out guide and out act government consensus builders. Today's private sector strategy is - safety now allows business now. Safety for employees. Safety for customers. And if you try to come in here without wearing a mask, then take your disrespect, go home and stay home. Just Say No (Remember that?) to disrespect.

Conclusion

Under any scenarios, Old Town Key West is a pleasant livelihood and its real estate is a rewarding and long term investment.The rebound is in sight. Add in the sanctuary and safe haven status presently and rightfully defended and offered exclusively to residents of the Keys, and owning a tropical home in Key West is a smart addition to both a new and re-engineered portfolio.

If you have any comments or questions, please contact me here.

Good luck. Wear a mask. Thank you.

Additional Resources: