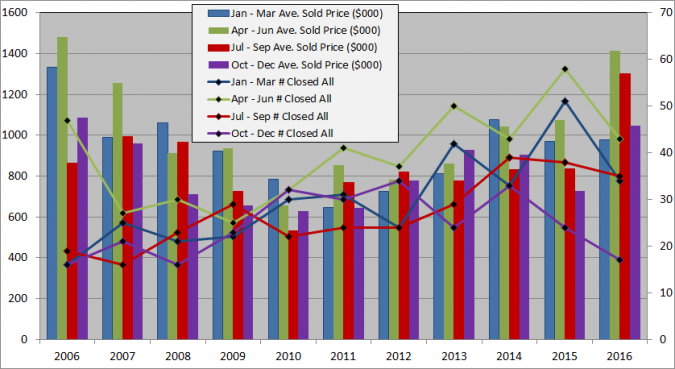

Every Quarter in 2016 had fewer sales than the same quarter in 2015. Yet, for each quarter, average sale prices were equal to or significantly higher than the same quarter in 2015. For 2016, number of sales were down 25% from 2015 and 10% below the 5-year average but the average sales price of $1.184M was 31% higher than 2015 and highest since 2006. The 2016 average sales price per square foot of $694 was 30% above the 5-year average. December was the 4th month in a row below 10 sales. Will rising prices grow inventory and create the much needed price competition necessary to increase sales?

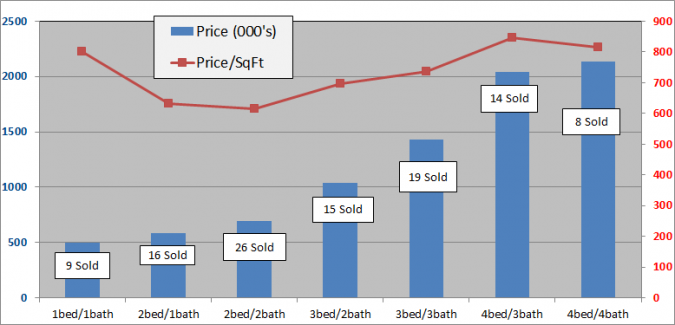

The below charts show sales of the seven most popular bed/bath combinations in Old Town Key West from January 1, 2006 to December 31, 2016.

These charts are for single family homes sold south and west of White St. and cover the neighborhoods of The Meadows, Old Town, Truman Annex and Casa Marina but not Sunset Key. You can view a neighborhood map here. The seven bed/bath combinations below contain enough sales to measure and evaluate trends after the 2004-2006 real estate Bubble.

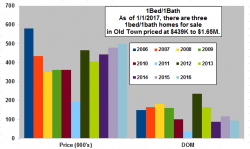

- Nine, 1Bed/1Bath homes have sold in the Old Town area thru 12/31/2016. The average Days of Market was 95 days.

- The 2016 average sale price of $498,000 is 4% above the average sale price for 2015.

- In 2015, twelve 1/1 homes sold, the most since 2001.

- The average size of the 2016 Solds is 621 sq.ft., slightly smaller than 2015; however,

- The average sale price per sqft. is $802. This figure is 12% higher than 2015 and highest since 2005.

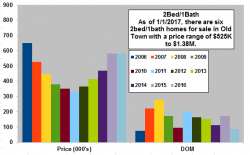

- Sixteen, 2Bed/1Bath homes have sold in the Old Town area thru 12/31/2016. The average Days on Market was 88 days.

- The average Sold price of $582,000 is the same as 2015 which was 25% more than 2014.

- Six 2/1 homes are for sale with prices from $525K to $1.38M.

- Fifteen 2/1 homes sold in 2011, sixteen in 2012 and twenty-one in 2013 but only fourteen in 2014 so twenty-three sales for 2015 was very encouraging.

- Since 2009, 2Bed/1Bath homes have been the 3rd most popular selling home in Old Town.

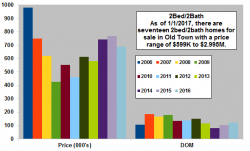

The 2Bed/2Bath home remains the most popular configuration with 26 sales in 2016 and #1 overall with 233 sales since 2006.

- Twenty-six, 2Bed/2Bath homes have sold in the Old Town area thru 12/31/2016. The average Days on Market was 123 Days.

- The average sold price of $690,000 is 10% below 2015 and only 62% above the low in 2009.

- Seventeen 2/2's are for sale, priced between $599,000 and $2.995M.

- Average Sold price per sqft in 2016 is $614, 7% below 2015 which was 15% more than 2014.

- Since 2009, 2Bed/2Bath homes have been the biggest sellers in Old Town Key West with 233 sales.

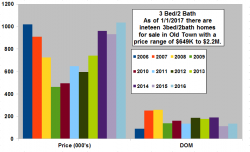

The 3Bed/2Bath average sales price of $1,035,000 is 124% above the 2009 low.

- Fifteen, 3Bed/2Bath homes have sold in the Old Town area thru 12/31/2016. The average Days on Market was 134 Days.

- The average Sold price of $1,035,000 is 11% above 2015, which was 3% below 2014, and is 124% above the 2009 low.

- Average sold price per sqft. is $696, up 12% from 2015, primarily because the fifteen homes sold are the smallest 3/2 homes sold since 2012.

- Twenty-seven 3/2's sold in 2014 and twenty-one sold in 2015.

- Since 2009, 3Bed/2Bath homes have been the 2nd biggest sellers in Old Town (153 sales) as value buyers take advantage of larger homes at low prices.

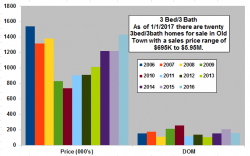

- Nineteen, 3Bed/3Bath homes have sold in the Old Town area thru 12/31/2016. The average Days on Market was 156 Days.

- The average sold price of $1.428M is 17% above 2015 and 93% above the 2010 low.

- The average size of the nineteen sold is 1938 sq.ft., largest since 2006 and the average Sold price per sqft. of $737 is the highest since 2008.

- Twenty-three 3/3's sold in 2014 and nineteen in 2015.

- Since 2009, 3Bed/3Bath homes have been the fourth biggest seller in Old Town Key West.

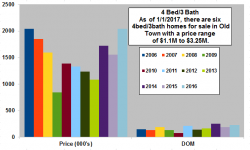

The 4Bed/3Bath average sales price of $2,038,000 is 141% above the 2009 low.

- Fourteen, 4Bed/3Bath homes have sold in the Old Town area thru 12/31/2016. The average Days of Market was 229 Days.

- The 2016 average sale price of $2.038M is 31% above 2015 which was 10% below the 2014 average sold price. $2.038M is 141% above the 2009 low.

- Average Sold price per sq.ft. is $846 is the highest since 2005.

- The average size of the fourteen sold is 2408 sq.ft., large beautiful homes.

- This Bed/Bath configuration has finally solidified its price reversal. Plus, the twelve sales in 2012, the highest since 2008, and seven sales in 2015, with a climbing average sales price per square foot, shows strength.

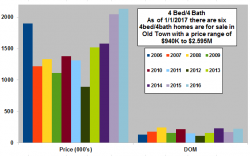

- Eight, 4Bed/4Bath homes have sold in the Old Town area thru 12/31/2016. The average Days on Market was 225 Days.

- The average Sold price of $2.132M is 4% above the 2015 average Sold price which was 30% above 2014 and is the highest recorded. The $2.132M is 92% above the 2009 low.

- The 2016 average sold price per sq.ft. of $815 is 9% above the 2015 average sold price per sqft which was 24% above 2014.Since 2003, average number of annual sales is six, with nine sold in 2013, ten in 2014 and six in 2015.

- Year to year price action is choppy as a limited number of annual sales causes large fluctuations in average sales price.

Summary

The 1st QTR of 2016 saw a GDP and market downturn with the possibility of a recession. Old Town home sales were down 1/3 from Jan-March 2015.

The 2nd and 3rd Qtrs fought through a slowdown in China, Brexit and uncertain international economic and US political news. Total number of single family Old Town sales still trailed 2015 but average sales prices soared in both quarters.

4th Qtr number of sales ended again below 2015 but the average sales price of $1.045M was the highest 4th Qtr value since the 4th Qtr of 2006.

Senior Economists from Asset Management and Mutual Fund companies like T. Rowe Price, Ladenburg Thalmann and Charles Schwab predict steady growth, rising equities and manageable interest rates all leading likely to GDP growth of 2% - 2.5% for 2017 and 2018. This, in the face of likely two interest rate hikes from the Federal Reserve, a rising dollar and the uncertain progress of the President Trump agenda to reduce taxes, personal and corporate, and regulations.

Abscent a significant external negative event, buyers (albeit a shrinking number) of Old Town Key West real estate will very likely continue to pay up for immaculate properties and personalized Brokerage service.

As always, Buyers should buy high quality homes with a true potential to rise in value and Sellers should price to sell at a market driven value.

If you have any comments or questions please contact me here.

Good luck!