We know that one of the rules of a 1031 Tax Deferred Exchange is you have 180 days after the closing of your "relinquished property" to close on the purchase of your "replacement property". Doing so, allows you to defer capital gains tax on the profits from the sale. But, if you can not close in 180 days then capital gains tax is due. What happens if those 180 days pass from one year to the next? When the 180 days "straddles" two years, in which tax year is the capital gains tax due? The choice is yours.

What are the basics of a 1031 Tax Deferred Exchange

The IRS Tax Code covering 1031 Tax Deferred Exchanges is designed to encourage investment in real estate. Through the purchase, sale and re-purchase of investment real estate, an investor can defer capital gains taxes while accruing ever more valuable real estate and rents.

An investor may sell one property in order to purchase many; or, may sell many in order to purchase one. The tax entity that sells must be the tax entity that buys. It gets a little tricky for entities that are not taxed; such as trusts and LLCs, this is where your Qualified Intermediary and tax advisor will provide guidance.

Otherwise, a house used as a annual rental can be sold and replaced with a strip mall. An apartment building can be sold and replaced with a single family home - that will be used as vacation rental. All property sold and bought must be within the 50 United States, the District of Columbia and the territories of the US.

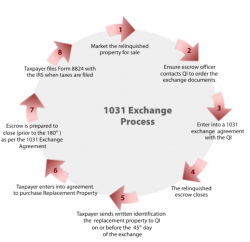

The basics are:

- Property sold and bought must be what is called "like kind".

- A 3rd party, specifically established as a "Qualified Intermediary (QI)", handles all of the proceeds from the sale and for the purchase. Unlike other sales of property, no monies go to or are handled by the seller.

- Within 45 days after the sale of the "relinquished property" a list of up to three properties must be submitted to the 3rd party QI. From among these three properties must come the property to be purchased as the "replacement property".

- Beginning on the day the "relinquished property" is closed, the seller has 180 days to close on the "replacement property".

- The "replacement property" must have a purchase price that is equal to or higher than the sale price of the "relinquished property".

- As long as all of the profits from the sale are used for the purchase, then no capital gains tax is due (deferred).

- If you do not utilize all of the profits from the sale of the "relinquished property" for the purchase of the "replacement property" then capital gains tax is due only on the portion not used.

What about the "Straddle?"

Suppose the sale of "relinquished property" closes on or after early July? Meaning the 180th day, by which the closing of the sale on the "replacement property" must occur, will fall into the next calendar year.

If there is no closing by the 180th day, then the Exchange is considered to have failed and the proceeds from the sale of the "relinquished property" are returned from the Qualified Intermediary to the seller. A failure of the Exchange means a capital gains tax is due on any profits from the sale of the "relinquished property". And yet ... if the proceeds of the sale of the "relinquished property" which are held by the Qualified Intermediary during the 180 days are returned to the seller in the year following the sale, then the taxes to be paid on the capital gains of the sale in 2023 are not due until taxes are paid for 2024 because in 2024 is when the seller actually obtained the proceeds of the sale.

The IRS allows the seller of the "relinquished property" to choose in which year the capital gains tax will be paid - the year of the sale or the year of the failed purchase. This is because the 180 day period "straddled" two tax years.

This choice can be of significant benefit to the seller. The seller can pay capital gains taxes for the year of the sale or use the proceeds for any means for an entire calendar year and pay the capital gains tax for the year of the failed exchange. Your 1031 Exchange has a one-year deferral as a back-up plan!

The above few points provide but a glimpse into this excellent program. There remain many intricacies and what ifs that only a Qualified Intermediary is qualified to answer. Your broker, attorney or closing agent is not, by definition, a Qualified Intermediary

Who is my preferred Qualified Intermediary?

Good question.

All of my 1031 Tax Deferred questions and transactions are handled by Diane Rivera. Diane is the Regional Manager and a Certified Exchange Specialist CES® for Starker Services, Inc., the pre-eminent 1031 Exchange specialist in the US. Starker is headquartered in Los Gatos, CA but Diane lives in South Florida.

You can email Diane at diane@starker1031fl.com.

If you have any questions or comments you can reach me here.

Good luck!

Additional Resources: