The 1992 Florida Legislature passed the William E. Sadowski Act which created the Sadowski Fund. The Fund has one dedicated purpose – to assist in every way to provide affordable housing for renters and home buyers in every corner of Florida. The Fund is funded entirely and continuously by a tax on real estate sales. Since 2000, the Florida legislature has taken monies out of the Fund for non-affordable housing purposes. During the budget process, money in the Fund has routinely been "swept" of billion$$ for other budgetary purposes. This conflict continues. Why?

_____________________________________________________________________________________

My first article about the Sadowski Fund detailed the primary source of revenue and the two primary programs by which the Sadowski Fund supports affordable housing initiatives. To summarize:

The source of revenue is simple, steady and guaranteed. Every time a piece of real estate sells; commercial or residential, there is a documentary stamp (doc stamp) tax. This is a transfer tax on the Deed. Initially the Fund received 10 cents per $100 of the sale amount, that figure now is 20 cents per $100 of the sale amount (For example - A sale amount equals $500,000. Divide by 100 equals 5000. Multiply by .2 equals a doc stamp tax of $1000). Therefore, the Florida legislature does not "fund" the Sadowski Fund, buyers and sellers of real estate fund the Sadowski Fund.

Since 1992, this small tax has sent over $6.6B to the Sadowski Fund.

The two primary affordable housing programs are:

- State Housing Initiatives Partnership (SHIP). SHIP provides funds to local governments to create public/private partnerships to renovate existing affordable housing and to fund emergency repairs, new construction, rehabilitation, assistance on down payment and closing costs, impact fees, construction and gap financing, mortgage buy-downs, acquisition of property for affordable housing, matching dollars for federal housing grants and programs, and homeownership counseling. Approximately 70% of the Sadowski Fund goes to SHIP.

- State Apartment Initiative Loan (SAIL). SAIL provides ultra-low-interest loans to developers for the construction or rehab of existing multi-family affordable housing. This money often bridges the gap between the developer's primary source of financing and the total cost of the development. SAIL dollars are available to individuals, public entities and not-for-profit or for-profit organizations that propose the construction or substantial rehabilitation of multifamily units for very low income individuals and families. Developers work directly with the State for funding. Approximately 30% of the Sadowski Fund goes to SAIL.

Historical demographic research from many social-science organizations shows affordable housing lowers homelessness, crime, drug use and provides a more stable and nurturing environment for families and communities.

Economically, the multiplying effect of the Sadowski Fund is enormous! Sadowski provides a base of funding, a down payment so to speak. From this base, state and local housing authorities can obtain additional private and public funding in the form of bonds or equity. Generally, for every $1 of Sadowski funding, $4 to $6 additional dollars are obtained through public and private funding.

According to the Florida Housing Coalition, in 2019 – 2020, local and state housing trust funds will contain nearly $330M. If this entire amount were used for SHIP and SAIL programs, over 28,500 jobs would be created with a resulting economic impact of $4B.

And yet, many people claim affordable housing initiatives are not making the grade. Why?

Impact Monroe County

Every three years Monroe County produces a report called the SHIP Local Housing Assistance Plan (LHAP). These plans take a 3-year estimated look at what can be done with an anticipated SHIP allocation. The allocation results from two factors; a combination of census data of population and income; i.e., need, and the doc stamp revenue produced by the county. The size of this anticipated allocation drives the estimated number of homes that can be rehabed, purchased and the approximate cost to do so. The LHAP is submitted to the Monroe County Board of County Commissioners (BOCC) and ultimately approved by the Florida Housing Finance Corporation. The most recent Monroe County LHAP is for 2017 - 2019, seen here.

The 2017 - 2019 LHAP projected a minimum allocation of $355,000 for 9 homes in each of 2017, 2018 and 2019. The nine homes was the estimate of homes that could be rehabed/bought, based on the anticipated minimum allocation, to satisfy existing and anticipated applications for housing. Neither specific properties nor their actual construction costs are a part of the LHAP. Why $355,000?

Monroe County is a non-entitlement county. Entitlement/non-entitlement is a Federal designation based on the size and population of a city, community or county. As a non-entitlement county, the minimum annual SHIP funding Monroe County can receive is $355,000. Additionally, as a non-entitlement county, Monroe County is too small to be directly entitled to affordable housing funding through the Community Development Block Grant (CDBG) federal program.

However, the State of Florida receives CDBG funding and distributes these funds based on a competitive basis. Monroe County routinely applies for these funds and has been successful in receiving the maximum annual award of $750,000.

#StoptheSweeps

In 14 of the last 18 years, including this year’s 2018-2019 budget, the State has “swept” money from the Sadowski fund for other State budgetary purposes; primarily, education and school safety. Since 2001, the State has swept almost $2.2 billion from the Sadowski Fund.

On November 7, 2018, the day after the Florida general election, the Orlando Sentinel published an op-ed request to the new Governor. The op-ed asked Governor-elect DeSantis to prohibit the legislature from “sweeping” money from affordable housing and placing it in the General Fund. You can read the op-ed here.

Top - Down or Bottom - Up

How are Sadowski funds allocated? What is the strategy?

- Bottom - Up: Local housing experts identify specific properties to rehab or buy along with their construction costs and pass a plan up the chain for approval and financing; i.e. increase capacity.

- Top - Down: Funds are distributed on an entitlement basis, based on census data of population and incomes; i.e. need.

SHIP program Sadowski Funds are allocated Top - Down. Priority is placed on need. Funds are not earmarked for specific projects; i.e. building capacity, rather Funds are distributed based on population, their reported income and anticipated doc stamp revenue.

According to Monroe County affordable housing authorities, unencumbered SHIP funds for 2017 - 2018 were allocated to Irma related Disaster Mitigation. As mitigation needs subside, SHIP funds are being directed back to their traditional purposes.

Yet, as need advances, capacity retreats. The Top - Down model is not delivering the goods - more affordable housing. Plus, it appears that affordable housing advocates have no change in the existing Top - Down strategy. Realizing that Sadowski Funds are not project specific and there is no anticipated change in the Top - Down strategy, politicians fear no major kick back from sweeps, calculating that those benefitting from sweeps have a likelier probability of expressing their thanks than the losers (and their Advocates) have in expressing their dismay.

What can you do right now.

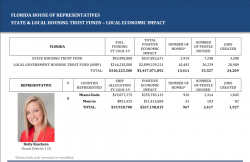

The next Florida Legislative session begins March 5, 2019. Right now, in the afterglow of the election, officials new and old are in a crush to staff up and get organized. Now is the time for all good citizens to come to the aid of their affordable housing needing neighbor. Send your State Senator and Representative an email asking them to not only safeguard the Sadowski Fund but for a complete reasessment of the strategic and tactical capabilities of the affordable housing initiative. For Monroe County contact:

- Senator Anitere Flores. Miami. 305.222.4117. Email: flores.anitere@flsenate.gov

- Representative Holly Raschein. Key Largo 305.453.1202. Homestead 305.242.2485. Email: Holly.Raschein@myfloridahouse.gov

Conclusion

Its a tug of war - emotional, rhetorical and practical.

On the one hand, the Sadowski Fund has a steady flow of money going to it from the sale of real estate statewide - $330M or so for 2018/19. Revenue is not the problem.

On the other hand, year after year, Budgeteers, attempting to balance the State budget, see Top - Down funds not targetted to a specific solution as uncorrelated funds and sweep them to be used to fund other higher profile programs. For 18 years! Sadowski advocates complain about the sweeps but appear to have no strategy to stop them.

It therefore seems that affordable housing advocates, top to bottom, need to generate a Bottom - Up strategy. $2.2B of $6.6B Sadowski Fund money have been swept by legislatures and the Sadowski advocates have not succeeded in stopping them. For 18 years! Why?

More local projects, that is, specific properties to rehab or buy and their construction costs, need to be approved for actual work and then paralleled up the political and housing chains of command. The drum for actual cost-of-project funding, tied to specific affordable housing projects, must be beaten through State Senators and Representatives. Earmarked funding with construction plans in hand and occupants at the ready is a defendable strategy. You can't sweep a good defense.

I have never heard an affordable housing advocate identify a specific project that failed to materialize or complete due to a sweep.

Given the unstoppable ability of legislatures to sweep Sadowski Funds in their present form, the practical reality is, not until targetted demand for affordable housing funding meets or exceeds funds available, will 100% of the Sadowski Fund be spent on affordable housing. Bottom-Up actual costs are more defendable than Top-Down estimated allocations.

If you have any comments or questions, please contact me here.

Good luck!

Additional resources: