The Immigrant Investor Program, also known as “EB-5,” was created by Congress in 1990 to stimulate the U.S. economy through job creation and capital investment by immigrant investors by either creating a new commercial enterprise or investing in a troubled business. The US Citizenship and Immigration Service (USCIS) administers the EB-5 Program. Under this program, entrepreneurs (and their spouses and unmarried children under 21) are eligible to apply for a green card (permanent residence) and within 5 years, citizenship. There are 10,000 EB-5 visas available annually.

The EB-5 Visa pathway for an immigrant investor to gain lawful permanent residence for themselves and their immediate family requires an investment in the Regional Center Program. This Program requires the immigrant to make a capital investment of either $500,000 in a Targeted Employment Area (TEA) or $1,000,000 in a new commercial enterprise located within the United States. TEA is defined by law as “a rural area or an area that has experienced high unemployment of at least 150 percent of the national average.”

The new commercial enterprise must create or preserve 10 full-time jobs for qualifying U.S. workers within two years (or under certain circumstances, within a reasonable time after the two year period) of the immigrant investor’s admission to the United States as a Conditional Permanent Resident (CPR).

Ten Basic Steps to EB-5 Success

It is helpful to remember the EB-5 visa has two separate paths through US Immigration & Citizenship Services (USCIS).

- The immigrant and immediate family members will be evaluated for “admissibility”, which applies the same to every green card seeker. Criteria that would keep you out of the US include felony criminal convictions, significant health issues, assets gained from illegal means, etc.

- The EB-5 requires you make an at-risk investment that creates, directly or indirectly, ten US jobs. A qualifying employee is a U.S. citizen, lawful permanent resident or other immigrant authorized to work in the United States including, but not limited to, a conditional resident, a temporary resident, an asylee, a refugee, or a person residing in the United States under suspension of deportation. This definition does not include the immigrant investor; his or her spouse, sons, or daughters; or any foreign national in any nonimmigrant status (such as an H-1B nonimmigrant) or who is not authorized to work in the United States. Note, you are an investor, not a manager, so there’s no requirement to hire these people yourself, work in the business, or even live in the same state as your investment.

- The remaining Steps 3 - 10 regarding hiring an immigration attorney, investment selection and visa processing can more easily be explained here.

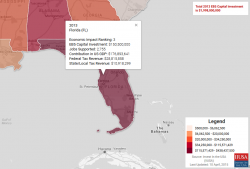

Immigrant Investment Regional Centers - Florida

Nationwide there are 883 Immigrant Investor Regional Centers. Some operate in more than one state, upping the total to over 1500 Centers. These centers are USCIS approved and can be either publically or privately owned and operated. (Caveat: USCIS makes no judgements about the skills or capabilities of any Regional Centers). In Florida there are 82 Centers. I asked USCIS if they maintain a data base of where these 82 Centers are located and if they had contact information for them. Unfortunately, the response was No - Just the name of the Center. Oh well.

I did find this website that lists nearly all EB-5 Centers nationwide. Many of the Centers in this web site have a hyperlink to their individual site.

The State of Florida currently maintains 33 Targeted Employment Areas (TEA) which includes Monroe County (excluding Key West). The 82 Florida Regional Centers overseeing these 33 TEA's coordinate EB-5 projects ranging from technology parks to assisted living facilities to eateries to mixed-use luxury developments.

Changes Are A-Coming

On May 4, 2017, Congress extended the EB-5 program pretty much "AS IS" through September 30, 2017. Under present consideration for change and modification are three areas:

- Increase the minimum investment amounts

- Re-define TEA's to encourage greater investment in rural or under-employed areas

- Encourage the use of EB-5 in the investment in infrastructure

The USCIS is proposing that investment minimums be raised to $1.35M from $500,000 for TEA's and investment in commercial enterprises be raised to $1.8M from $1M. Many people interpret this as a "shot across the bow" from USCIS in an effort to prod Congress to review not just increases in investment but the EB-5 Program overall.

A cursory review of available evidence shows a wide range of opinions and data on the effective use of EB-5 investment into established Targeted Employment Areas (TEA's). On the one hand, some reports reveal a very high percentage (99%) of people electing to invest in a TEA. However, critics will point to how some TEA's are constructed by state officials; i.e., combining census data to indicate the TEA has an unemployment rate favorable to the investment criteria even though the actual project might not occur in the high unemployment area. A snapshot of reform attempts over the past few years can be read here.

Using EB-5 investment to fund infrastructure projects benefits everyone involved. Such investment is often done by investing through an EB-5 bond project. EB-5 investors pool resources into an investment entity and that entity buys the bond. The investor(s) are financing the project. This is different from buying the bond on the open market as the investor would not actually be investing IN the project.

Benefits would be; the overall Cost of Capital for the project is reduced, jobs are made in abundance and oversight is already built into the project governance. For the foreign investor, tagging on to a public-private infrastructure project significantly increases the likelihood of visa approval and a clearer pathway to US citizenship.

Conclusion

The USCIS estimates that since 2012 at least $8.7 billion has been invested in the U.S. economy and 35,150 jobs have been created through the EB-5 program.

Presently Senators Schumer and Cornyn and separately Senators Leahy and Grassley have bills before the Senate to modify the EB-5 Program. Let's hope the goal and objectives of these bills are to encourage more investment, to create more jobs and to distribute investment as equitably as possible. Strangling the program through regulation and oversight would serve no purpose.

If you have any comments or questions please contact me here.

Good luck.

Additional Sources: