Come and listen to a story about a man named Jed, a shoddy real-a-tor, barely kept his family fed ... Story goes ole Jed sold Key West real estate up the bubble on the promise that up was everywhere and no sky was high enough to hold prices. Don't worry he'd convince, calculating his 7% commission, in two years you'll make back your rental losses and 30% to boot. Problem was, Jed ate his own cookin', bought the top and when his clients tracked him down, he nearly bought the farm. Fortunately for Jed, the markets are back. And I can prove it.

In Conclusion

When I started being a realator in 2000 or so I realized I didn't possess the schmoozability to convince people I didn't know to buy homes at $600, $700, $800 per square foot (and up!). I also knew that after being a carrier jet pilot for the Navy for 20 years I probably didn't have the contestinal fortitude to hold people's wringing hand while they decided what to do.

As a pilot I never launched without knowing where I was going, how I was going to get there (and back) and how I was going to do whatever I had set out to do. Precisely, and with a reasonable knowledge of the rules of aeronautics, 6-D geometry and fore sense, I made it out and back each time. I saw in real estate little of this precision from anyone; therefore,

In Conclusion, Part II

I decided I'd have something to ACTUALLY back up what I was saying, like sale prices and days on the market. If I had something for the buyer and seller to look at, maybe they'd think I knew what I was talking about - as opposed to those realators who dint.

I have sale price and days on the market data from January 2000 to today. At the end of every month I write a short article detailing this information so you can see exactly what is happening. I've found that if you know where you've been, and you know where you are, you have a fairly reasonable chance of estimating where you might end up - assuming you have enough jet fuel and altitude.

You can read my report on sales of single family homes in Old Town Key West through the end of March 31, 2014 right here.

By reading the report thru March 31, 2014 you'll see clearly that single family home sales in Old Town are up well from their 2010 bottom. Some home groups are up 70% from their bottom. All of Key West has rebounded. Sale prices for non-Old Town neighborhoods might not be as high as Old Town but no doubt they're up.

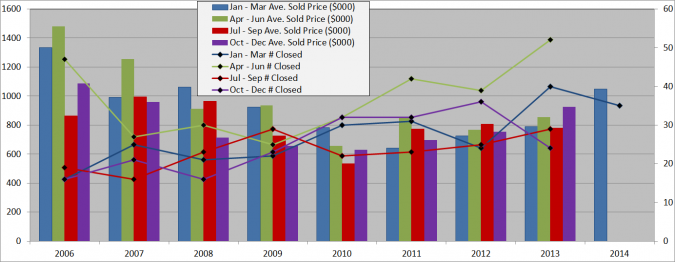

In the below chart I've looked at Old Town, single family home sale prices and number of sales per Quarter since January 01, 2006. The verticle bars are sales prices, scaled on the left hand side in $000. The lines represent number of sales per quarter. Their scale is on the right side of the chart.

There are a few obvious take aways from the below chart:

Prices:

- The affluent buyer went to the sidelines in 2009 and is still there

- Prices bottomed in 2010

- Whereas during the downturn, sale prices could vary significantly per quarter, recovery sale prices have been smooth and orderly. Prices now reflect a value orientation, not emotional as during the run-up in 2004 - 2006.

- Lending even more stability, prices in the 2nd half of the year are now stronger showing that home buying is more of an annual process not just a January to June "season".

Closings:

- Most closings occur April to June (30- 45 days after the contract for sale is agreed upon). This is to be expected as more people come to Key West in the winter months. When the North gets a Cold, Key West gets a Sold.

- July thru September still lags (Hint: Bargain hunters come on down. Look for properties that were listed but didn't sell from January to June).

- The number of Closings is recovering faster than prices. Take note: Closings for October to December 2013 hit a wall and January to March 2014 also broke rising trend lines. (Answer: Too many economic and tax related uncertainties).

In Conclusion, Final Chapter

What I learned from ole Jed is, it is better to tell clients what they don't know they know then it is for them to learn on their own that you didn't teach what should have been taught.

Stay tuned for April's Old Town home sales report, due out the first week of May.

If you have any comments or questions, please contact me here. I'll email you my reports directly if you'd like.

Good luck!