A Real Estate Investment Trust (REIT) is a mutual fund-like investment device that trades like a stock. REITs invest in multiple properties of a specific and similar type, retail stores/malls, hospitals, apartment complexes, etc. The REIT must pay out 90% of its profits (as a dividend), in order to avoid corporate income taxes. There are Equity REITs that earn income from rents and Mortgage REITs that loan money and earn income from loan payments. Investors use REITs, with their diverse asset base and dividend commitment, as safe havens. Below are several REITs to review.

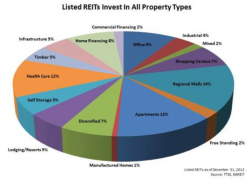

Congress created REITs in 1960 to make investments in large-scale, income-producing real estate accessible to average investors. A REIT does not develop real estate properties to resell them. A REIT buys and develops properties primarily to operate them as part of its own investment portfolio. Approximately 90% of REITs are Equity REITs.

There are about 300 REITs operating in the United States today. Their assets total over $300 billion. About two-thirds trade on the national stock exchanges. Additionally a variety of land owning companies have converted to REIT status; such as Weyerhauser (WY) and cell phone tower owner American Tower (AMT).

Cole Real Estate Investment (COLE)

COLE invests in retail, office and industrial properties nationwide. It has a 3 year EPS growth rate of approximately 205% and a 3 year Sales growth rate of 90%. American Realty Capital Properties (ARCP) recently reached a deal to buy COLE, valuing the transaction at $11.2 billion and will create the largest net lease REIT with an enterprise value of $21.5 billion. The Merger Agreement has been unanimously approved by the board of directors of each company. The combined company portfolio will consist of 3,732 properties leased to over 600 tenants occupying over 100 million square feet in 49 states and Puerto Rico. COLE shares jumped 9%.

Other retail REITs of note are mall investors Simon Property Group (SPG) and Tanjer Factory Outlet (SKT) and Western US shopping center owner Retail Opportunity Investments (ROIC).

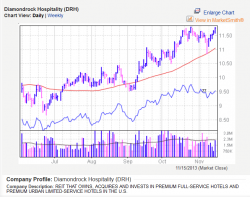

Diamondrock Hospitality (DRH)

DRH owns a portfolio of 27 premium hotels throughout North America and the U.S. Virgin Islands that operate under the lodging brands of Hilton, Marriot, Starwood and Westin. DRH has a 3-year Sales Growth rate of 21%. DRH is capitalizing on the premium international traveler. DRH recently concluded a $46M renovation of its Lexington New York City Hotel.

Other lodging REITS of note are upscale hotelier Peeblebrook Hotel Trust (PEB) and urban hotel an convention center operator Chesapeake Lodging Trust (CHSP).

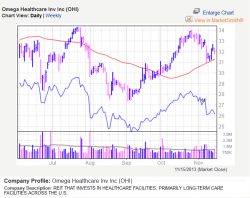

Omega Healthcare (OHI)

OHI owns or holds mortgages on 477 skilled nursing facilities, assisted living facilities and other specialty hospitals in 33 states that are operated by 48 third-party healthcare operating companies. OHI has a 3-year EPS Growth rate of 64% and a 3-year Sales Growth rate of 18%. Its dividend is $.48 per share which, at $33 per share, is a 5.7% yield. OHI is positioned to care for the aging US population and is held by the Harvard investment trust.

Other healthcare REITs of note are long term care provider National Health Investor (NHI) and rehab and acute care operator Medical Properties Trust (MPW).

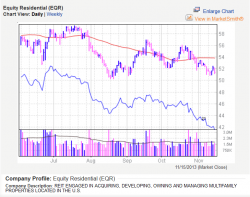

Equity Residential (EQR)

EQR and Camden Property Trust (CPT) own and operate large apartment home complexes nationwide. Apartment developers are building to meet high demand. But they're running into rising costs for everything from workers and loans to drywall, lumber and concrete, hurting profits and project timing.

Construction materials prices are up as producers and distributors, who downsized after the housing bubble burst, now lack capacity to meet demand as the housing market recovers.

A shortage of skilled carpenters and other workers in some areas is contributing to higher labor costs. And rising interest rates are making it more expensive to finance projects, causing some delays.

Conclusion

REITs offer the individual investor an opportunity to buy into large scale real estate businesses and receive a steady dividend from real estate centric industries where picking winners and losers can be a challenge.

If you have any questions or comments please contact me here.

Good luck.

Additional Resources: