You can profit by buying home builders; MI Homes (MHO), Ryland Group (RYL), etc. You can profit from companies that support builders and remodelers like Lumber Liquidators (LL), Valspar Corp (VAL). You can profit from Do-it-Yourselfers (DIY) like Home Depot (HD) and Lowe’s Companies (LOW). How about a different approach. Why not take advantage of firms that administer loans and refinancing? Like dry goods stores that profited from the California gold rush even when miners didn’t, a company that administers the processes of real estate transactions can provide the pick and shovel profits of all transactions.

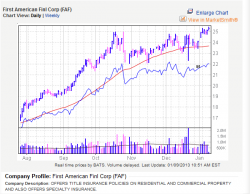

How about title insurance company First American Financial?

First American Financial (FAF) is up 94% over the past 12 months, beating the S&P 500 by 79%.

FAF profits from new home purchases and refinancings (refis). It holds 27% of the U.S. title market (second to Fidelity National Financial (FNF) at 34%). Refis comprise 65% of FAF's business. Yet, home purchases provide twice the revenue and profits then refis.

There is debate over whether or not refis will stay strong. Most point to continued strength in refis as interest rates are expected to stay low and the Home Affordable Refinancing Program (HARP) assists home owners to refinance. Refis could also provide a steady cash flow as home values increase and property owners tap new equity for home fix-ups. For 2013, the Mortgage Bankers Association (MBA) predicts a 35% drop in refis but a 15% increase in home purchases. With fees for homepurchases approximately double that of refis, its almost a no-lose situation regardless the direction the industry moves.

Total revenues for the 3rd quarter of 2012 were $1.2 billion, an increase of 25 % over the 3rd quarter of 2011. Net income in the 3rd quarter was $103.5 million, or 95 cents per diluted share, compared with net income of $21.0 million, or 20 cents per diluted share, in the third quarter of 2011.

Direct premiums and escrow fees were up 29 % from the 3rd quarter of 2011, driven by a 35 % increase in the number of title orders closed in the quarter. In October 2012 the Board of Directors declared a quarterly cash dividend of 12 cents per common share, a 50 % increase from the prior level of 8 cents per common share.

FAF's earnings have grown faster than revenue as fixed costs, such as labor and compensation, have been closely controlled. Though claims have inceased significantly, hiring and compensation have risen only slightly.

Matching its financial performance, FAF is also a player in the community outreach arena for housing-related activities through its Caring for Our Community (COC) program. In 2011-12, COC provided hands-on participation with Habit for Humanity in Dallas, TX, Lake Forest, CA and Phoenix, AZ.

First American Financial is headquartered in Santa Ana, CA. FAF has offices in all 50 states and Canada. First American was the first title insurance provider in Mexico, Korea, and Hong Kong, and has the leading market share in Australia and England.

If you have any comments please contact me here.

Thanks and good luck.

Additional Resources: