The mortgage interest deduction (MID) is one of the largest tax expenditures in the US tax code. Given the dissatisfaction with the US tax code overall and the huge federal budget deficit, policymakers debate how to kill these two buzzards, reducing the federal budget deficit while simultaneously simplifying the federal tax code, with one magic stone. Eliminating the mortgage interest deduction is frequently identified as a tax code item that can do both. Many real estate professionals defend the MID as sacred. Question: If MID encourages home ownership, does it do that for everyone or just a few?

What tax benefits do homeowners enjoy?

Home owners are allowed to deduct the interest paid on up to a $1 million mortgage and up to $100,000 in additional debt backed by home equity. Home owners are also allowed a deduction for state and local property taxes and are exempted (in part) from taxes on the capital gains from the sale of a home. These preferences for home ownership fall under the umbrella of "tax expenditures," or special benefits by lowering tax liabilities. Tax expenditures technically reduce the amount of taxes paid, but they resemble direct spending programs more than they do typical tax laws. The tax benefits for home ownership are thus essentially subsidies.

The cost of the tax benefits for owner-occupied housing adds up to about $175 billion annually, with the mortgage-interest deduction costing roughly $100 billion (in 2013). The five-year costs of these tax benefits total over $1 trillion. To put this amount in perspective, one year of tax benefits for owner-occupied housing costs more than the discretionary budgets of the departments of Education, Homeland Security, Energy, and Agriculture combined.

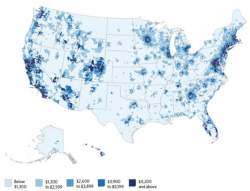

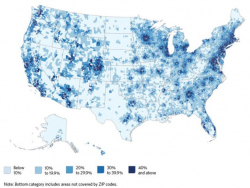

Dr. Andrew Hanson, PhD, Associate Professor in Economics at Marquette University has written two research reports commissioned by The Pew Charitable Trusts and the R Street Institute, that examined the Mortgage Interest Deduction. His findings reveal that less than a third of taxpayers actually benefit from the deduction, and most of the benefit is skewed to those who earn more than $100,000 per year and who live primarily on the East Coast and California.

“The two greatest misconceptions about the mortgage interest deduction are that many people benefit from it and that it promotes homeownership,” Hanson says. On the contrary, “Those who benefit from the deduction are not deciding between renting and owning – they’re deciding between (selling) a large home and (buying) an even larger home.”

What are some homeownership tax alternatives?

In the Spring 2014 issue of National Affairs, Dr. Hanson, Ike Brannon, President of Capital Policy Analytics and Zachary Hawley of Texas Christian University made a statistical based analysis of the benefits of MID and associated home ownership taxes, who benefits and who does not. Their evidence points to the benefits of MID almost exclusively to higher income families, yet nearly non-existent for middle income and lower income families - in effect a subsidy for wealthy homeonwers.

Hanson, Brannon and Hawley offer a selection of alternatives that they believe would expand home ownership. (Research panels from President G. W. Bush and President Obama have also made these recommendations). Among these ideas are:

- Capping the size of mortgages that qualify for a MID (Either a National cap or one that depends on Regional property values).

- Eliminate the MID in favor of a more straightforward (15%) tax credit.

- Make the tax credit refundable for lower-income taxpayers.

- Limiting the amount of capital gains that are exempt from taxation when the homeowner sells their home.

In many ways, present homeowner tax expectations inflate home prices. Changing the tax treatment of home ownership would reduce or eliminate that inflation; but, whoever owns a home when the policy is eliminated would suffer a loss of value in their home — raising problems of fairness, questions about incremental initiation of tax changes and the role of government in directing home ownership.

What is the position of the National Association of Realtors?

On Wednesday, Feb. 26, 2014, House Ways and Means Committee Chairman Dave Camp released a draft for comprehensive reform of the entire tax code. As should be expected, many of the draft provisions affect real estate.

In response to this draft, National Association of Realtors® (NAR) President Steve Brown replied: "We are extremely disappointed with several of the provisions contained in U.S. House Ways and Means Chairman Dave Camp’s tax reform draft released today, namely proposed limits on the mortgage interest deduction and capital gains, and the repeal of deductions for state and local property taxes."

NAR has issued a well written evaluation of ten tax issues that most apply to encouraging and maintaining homeownership and their impact. Among these ten are; reducing the MID, modifying the exclusion of gain from the sale of a principle residence, repeal of 1031 tax-deferred exchanges, increasing the standard depreciation, etc. NAR's evaluation of the draft tax code changes that effect real estate are available here.

At every issue, NAR defended its interests as holy and argued the proposed changes as catastrophic.

I was reminded of something I had recently read: Your influence is determined by how abundantly you place other people's interests first - The Third Law of Stratospheric Success..

In Conclusion

And so you have it. If the statistical evaluation of the merits of mortgage interest deduction points to selectivity and a narrow group of beneficiaries such that it really does not expand home ownership, what does it say about NAR's position that changes in the Mortgage Interest Deduction and other related taxes are bad and all real estate will fall to hell in a hand basket?

If you have any comments or questions, please contact me here.

Good luck!

Additional Resources: