Ahhh Florida. Sandy beaches, blue skies, Cape Canaveral. Grapefruit League baseball. Thoroughbred horses and winter strawberries. International Miami. Down home Pensacola. The only state capitol not overrun during the Civil War. Exploding solar energy. No state income taxes. No estate or inheritance taxes. No state taxes on capital gains. Top 5 ranking for business environment. More jobs then people to get them. In Key West, a vibrant arts and music community. Historic homes from the late 1800's and early 1900's. A safe living environment. Bicycles. Churches, historic cemetery, 170 year old lighthouse and the Florida Keys National Marine Sanctuary.

_______________________________________________________________________________________

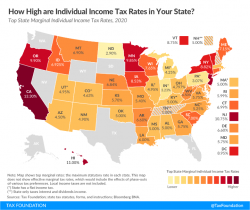

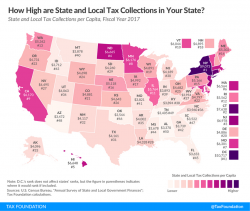

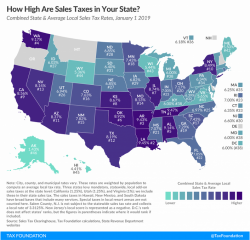

Florida ranks #11 in the state and local tax burden at 9.1%. New York, Connecticut, Hawaii, Vermont, California and New Jersey are the worst. Florida ranks #4 in State Business Tax Climate. New Jersey, New York and California are ranked the worst. Florida ranks #7 in gasoline taxes and #13 in Property Taxes. Monroe County is ranked #1 in total Property Tax levied; however, this is due to high property values as a 2022 County-by-County comparison shows Monroe County, out of 67 counties in Florida, as having the lowest Property Tax millage rate (8.8160) in the state.

Become a Floridian

Driver's License and Register to Vote

First off, it ain't just 1 - 2 - 3. There are many steps to take to properly and legally establish residency in Florida and also to un-establish residency in your previous state. Let's begin with the four steps to take first:

- Get a new place to live. Renters will need a Lease Agreement. Property owners will need a copy of their Deed or Property Record Card. A utility bill in your name is a reasonable substitute but a Lease or Deed are best.

- Driver's License. The only Driver's License office in Key West is located at 3304 N. Roosevelt Blvd (next to the Publix grocery store). Call 305.293.6338 to ask what documents you need (lease, Deed, passport, etc.) and to make sure they are open. Note: A Florida Driver's License shows intent to live in Florida, not necessarily residency.

- A Florida Driver's License makes registering to vote much easier. In fact, in Florida you can register to vote at the same time you obtain a Driver's License. If you want to register to vote online, you must first have a Florida Driver's License. If you want to register to vote in person, the office is downtown Key West at 530 Whitehead St.

- Don't forget to insure all vehicles, motorcycles, boats, etc. using Key West as the primary location of use. When you register these vehicles in Monroe County, at the Harvey Government Building, 1200 Truman Ave., Key West. you will need proof of insurance showing a local address. If you keep a car at a second home not in Florida, be sure to change the registration and insurance also to Key West. The location of use can be identified as at that second location but title and registration should be Florida.

Declaration of Domicile and Homestead

Florida Statute §222.17 states that a person can show intent to maintain a Florida residence as a permanent home by filing a sworn Declaration of Domicile with the local Clerk of the Court.

The Florida Declaration of Domicile must be signed by you in front of a notary public or the deputy clerk of a Florida court. It will then be recorded in the public records of the Florida county where you reside. Although signing and recording a Florida Declaration of Domicile is not required to establish your Florida residency, it does put the public on notice that you have indeed made Florida your permanent home.

There is no online form for a Declaration of Domicile in Monroe County. The form is available in person at the Monroe County Clerk's Office which is located on the 1st floor, rear at 530 Whitehead St., Key West. All that is necessary is a form of identification.The phone number for the Clerk's Office is 305.292.3458.

Homestead Exemption allows the property owner of a primary residence to not experience the full rate of property tax increases. Additional exemptions that are based on age, income, disability, etc., are available. At the end of every year the Property Appraiser's office asks if the exemptions should stay in place. As long as there is NO change of residency or ownership on the property which is receiving Homestead Exemptions, the exemptions for the upcoming year will automatically renew.

If at some time you are unable to pay property taxes then a Homestead Tax Deferral is available. Applications for Homestead Tax Deferral are due to the Tax Collector by March 31 and take effect for the following tax year. The application must be submitted in person at the Property Appraiser's office.

The Property Appraiser's office is located on the 1st floor, rear in the building next to the Clerk's Office. The phone number is 305.292.3420.

Show me the Money

In some way establish a local bank account. The easiest way is to let your Big Bank (Bank of America, Wells Fargo, etc.), credit union, financial institution and investor services agencies know your new primary address is Key West. Credit cards as well. Pay your Key West utilities, cable and internet services via auto pay. Use the account established in a Key West branch of your Big Bank.

Adios to state income taxes! When you file the final state income tax in your former state, make sure you identify on that final state income tax return that you ain't gonna be giving them no more of your hard earned cash.

Note: Do be aware though that if you earn income in a state other than Florida you will still have to file a non-resident return for the state in which you worked.

All the rest

There are a hodgepodge of Things To Do to add gravitas to your Residency in Key West:

- Start or transfer a business to Key West

- Get a W-2 paying job in Key West

- Readdress all of your IRA's, 401K's and Retirement wages and benefits to Key West

- Update wills and powers of attorney

- Join the Key West Chamber of Commerce

- Join your local church, synagogue or mosque

- Join local organizations; PTA, Rotary, Theater and Arts Society, etc.

Conclusion

Final note. It is hard severing ties to your previous residence; but, it must be done, otherwise the Taxman Do Cometh. If you retain business or social or second home status in another state be very certain that all permanent addresses associated with those ties point to Key West.

Consult your attorney and tax consultant to make sure you have covered all your bases. I have read multiple stories where states have laid successful claim on unpaid taxes or disability benefits INCLUDING PENALTY AND INTEREST all because of a leftover connection to the past residence. Be careful -

Meanwhile - Welcome to Key West!

If you have any comments or questions, please contact me here.

Good luck!

Additional Sources: