The 1031 Tax Deferred Exchange program is a real estate success story there is no denying. Granted, some top .01% of income earners have used 1031's to amass great wealth. So be it. Meanwhile, data shows that 38% of all 1031's have been in the buying and selling of multi-family rental properties, hardly mogul territory, with 16% of 1031's being in retail. Small to medium size investors use 1031's to create rental income and wealth for their families. Why punish them?

________________________________________________________________________________________

Section 1031 of the Internal Revenue Code traces its origin to The Revenue Act of 1921. Modifications to The Revenue Act in 1924 and 1928 lead to the creation in 1935 by the Board of Tax Appeals of the first modern tax-deferred like-kind exchange using a Qualified Intermediary (Accommodator).

In 1977 the landmark Starker case of T.J Starker and his son Bruce Starker resulted in an Amendment to the Federal Tax Code which changed Section 1031 of the Internal Revenue Code and established the description, definition and laid the groundwork for the current day structure of the tax-deferred like-kind exchange transaction.

1031 Tax Deferred Exchanges are sometimes referred to as a Starker Exchange.

President Biden's 1031

There is no limit to the dollar value of the deferred capital gains. President Biden’s proposal does not limit or restrict the exchange of like-kind properties. Instead, the President's proposal focuses on the amount of capital gains that can be deferred to a maximum of $500,000 per year or $1 million if filing a married filing joint return. Capital gains above these amounts are to be taxed at the ordinary income tax rate for taxpayers with adjusted income exceeding $1M.

Writing off the first $500,000/$1M is certainly a benefit for the 1031, but President Biden’s overall proposals for taxation also raises the highest ordinary income tax rate to 39.6%. Therefore everything over $500,000/$1M would be taxed at 39.6%, negating much of the existing benefits of deferring taxes on the capital gains that result from the exchange.

The Joint Committee on Taxation (JCT) estimates that $9.9B in tax revenue was lost in 2019 because of real property like-kind exchanges. The JCT estimates this loss will grow to $51.0B during 2019 to 2023. 1031 advocates argue that the loss in Treasury revenues was well below $4B in 2019 and will be below $20B during 2019 to 2023. This is because, not factored in to the JCT estimate are:

- The income tax consequences to the investor subsequent to the year of the exchange and,

- The positive impact on area economic activity that results from the 1031 exchanges and the downstream federal, state and local taxes paid by investors, suppliers and consumers.

The Biden proposal assumes that, by 2023, tax revenues generated by imposing the $500,000/$1M cap and taxing the "excess" capital gains at 39.6% would equal $1.9B.

The Cost of Capital

Investors desire a pre-tax return that exceeds what is required to cover taxes and compensate them for the use of their own capital. This pre-tax return is referred to as the cost of capital. Taxes raise the investors’ cost of capital because they must to earn enough to cover taxes and still pay a competitive return.

One of the purposes of 1031 exchange rules is to decrease and/or defer tax liability and, in turn, decrease the cost of capital. Such a decrease in tax liability and decrease in the cost of capital encourages not only initial investment but additionally encourages improvements to the investment property after purchase and during ownership.

Economic Activity

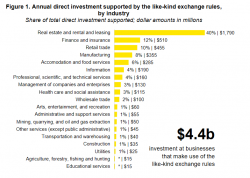

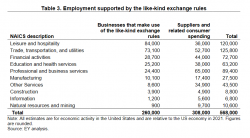

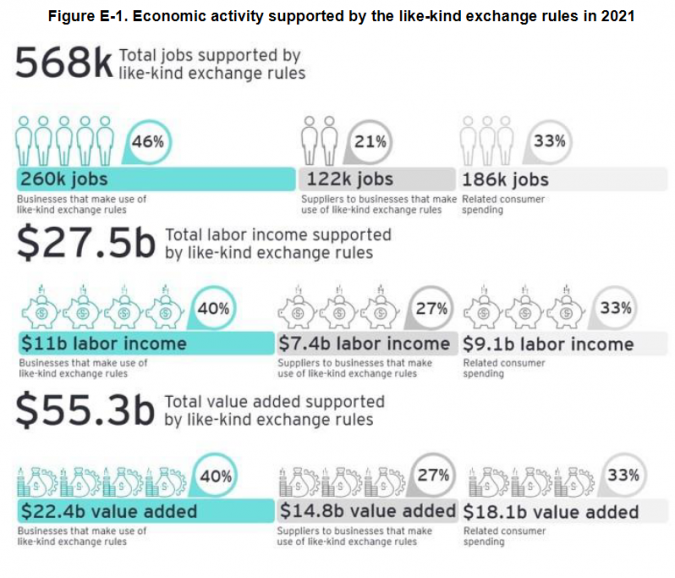

1031 exchange rules directly support $4.4 billion of annual investment by those investors that use the 1031 exchange. In 2021, 260,000 workers earning $11 billion in wages and benefits were supported directly by the like-kind exchange rules. Suppliers to the businesses that make use of the 1031 exchanges employ an additional 308,000 workers earning $16.5 billion in wages and benefits with a total benefit of $55.3B to U.S. GDP.

1031 exchange rules reduce the cost of capital; i.e., defers taxes, which results in greater investment in jobs and product or service production. Instead of paying taxes on capital gains, 1031 exchange rules result in the faster and more efficient redeployment of capital for local/area economic development.

The industries with the highest amount of investment directly supported by the 1031 exchange rules are real estate and rental leasing ($1.790B), finance and insurance ($510M), retail trade ($455M), manufacturing ($355M), and accommodation and food services ($285M).

1031 Contributions

Based on research from the National Association of Realtors, Marcus & Millichap Research Services, CoStar, National Council of Real Estate Investment Fiduciaries, IPX1031® and other real estate sources for the period January 2010 to June 2020 it is estimated that:

- 1031 exchanges comprise 10 to 20 percent of all commercial real estate transactions with 38% of these transactions involving multi-family housing

- The median sale price of a property involved in a 1031 exchange is approximately $575,000, indicating it is regular taxpayers, not institutions or corporate forms of ownership, which perform the majority of 1031 exchanges.

- 1031 exchange properties receive a post-sale investment on average of 15% greater than when a comparable property is purchased in a non-exchange, fully taxable sale.

- Sale prices of the replacement property range from 14% to 17% higher than the relinquished property’s sale price.

- From a 2020 NAR survey, 89% of 1031 exchange buyers invested additional equity capital to improve their replacement property which was equal to 18% of the market value of the acquired property.

- Only 12% of 1031 exchange transactions were followed by another 1031 exchange, negating entirely the claim of “swap till you drop”.

Conclusion

1031 exchanges are an important tax strategy that enables smaller, non-institutional investors to buy and sell investment properties on a tax-deferred basis. These same investors then invest into their new property, increasing market value and improving quality of life for the business or for the tenant. To offset the loss in tax benefits associated with the elimination or curtailment of exchanges, property values would have to decline or rents would have to increase.

Secondary impacts to eliminating or strangling 1031 exchanges would be fewer exchanges happening over extended periods of time and a decrease in post-exchange investment, both of which would decrease the flow of money in the market area of the exchange and would negatively impact suppliers, construction and employment.

A special Thank You to Lynn Harkin, Executive Director for the Federation of Exchange Accommodators and to Diane Rivera, Regional Manager, Miami, FL, for Starker Services.

If you have an comments or quesions, please contact me here.

Good luck.

Additional Resources: