On June 7, 1776, Richard Henry Lee, delegate from Virginia to the 2nd Continental Congress, motioned for independence from Great Britian. His "Lee Resolution" was accepted, a committee formed to draft a Declaration, the Draft was written, debated, edited, approved and signed by 56 Founding Fathers on August 2, 1776 - a period of 55 days. The National Flood Insurance Program (NFIP) has been extended 29 times between 2008 and (now) to September 2019 by 535 Politicians in Congress who can not play nice and get this flood insurance problem solved. How Come?

___________________________________________________________________________________

A brief review of the previous eight articles on this subject -

- Is Your Flood Insurance Going Up - Part VIII (May 2018) - New elements of the projected bill including "inland storm surge", new mapping techniques and grandfathering.

- Is Your Flood Insurance Going Up - Part VII (August 2017) - Review of the new, bipartisan Senate bill called "The Sustainable, Affordable, Fair and Efficient National Flood Insurance Program Reauthorization Act (SAFE NFIP) 2017.

- Is your Flood Insurance Going Up - Part VI (June 2016) - Update of the FEMA RiskMap mapping project begun in 2013.

- Is Your Flood Insurance Going Up - Part V (July 2014) - Details of the FEMA mapping effort for the Keys and South Florida including an extensive Outreach Program.

- Is Your Flood Insurance Going Up - Part IV (March 2014) - Recap of the March 2014 Homeowners Flood Insurance Affordability Act (HFIAA).

- Is Your Flood Insurance Going Up - Part III (October 2013) - Realization by politicians, including a co-author of flood insurance legislation called the Biggerts Waters Insurance Reform Act of 2012 (BW-12), that BW-12 was causing the consumer more harm than good, aka "unintended consequences".

- Is Your Flood Insurance Going Up - Part II (September 2013) - Treatment of historic buildings, second homes, businesses and no more exemptions under BW-12.

- Is Your Flood Insurance Going Up - Part I (January 2013) - Flood insurance rate changes and their justifications according to BW-12; i.e., refund the bankrupt NFIP.

Corelogic ranks Florida the #1 ranked high risk state for storm surge damage, with 2.9 million homes (of all styles) at risk and a total replacement cost value of $603B. In the Miami metropolitan area, which includes West Palm Beach and Fort Lauderdale, 827K homes are at risk with an estimated replacement cost of $166B. At year end 2018 in Florida, the NFIP reported total policies in Florida of 1.76 million. Louisiana ranks #2 at 847K homes.

On June 13, 2019, the House Financial Services Committee, by a bipartisan vote of 59 to 0, approved a comprehensive measure (H.R.3167) that includes a number of reforms from Republican and Democratic lawmakers to increase affordability, improve mapping, enhance mitigation and modernize the NFIP.

Will this get the job done?

The #1 Problem is Affordability

Do you insure your $50,000 BMW for $10,000? Do you insure the beautiful diamond ring you bought your wife for 1/5 its value? When you bought a term-life policy on yourself to help your wife and your two kids through what will likely be the worst period of their lives, did you buy a policy for a measly $20,000? Heck no. You bought and buy insurance on a risk-assessed basis to put your life and property back in order.

Thru the 1st Quarter 2019, in Old Town Key West, the average sales price for a single family home since January 2016 has exceeded $1M for eleven of thirteen Quarters. The cap on a NFIP flood coverage for a residential dwelling is $250,000. Flood insurance coverage for less than 25% of value?!

NFIP was self-sustaining until 2005.

- In 2005 FEMA borrowed $17.5 billion for claims related to Hurricanes Katrina, Rita, and Wilma.

- In 2012 FEMA borrowed $6.25 billion for claims related to Superstorm Sandy.

- In 2016 FEMA borrowed $1.6 billion for claims related to a series of floods.

- In March 2017, FEMA’s debt stood at $24.6 billion. Later in 2017, Hurricanes Harvey, Irma, and Maria caused FEMA to estimate it would be unable to pay related claims before reaching its $31B borrowing limit.

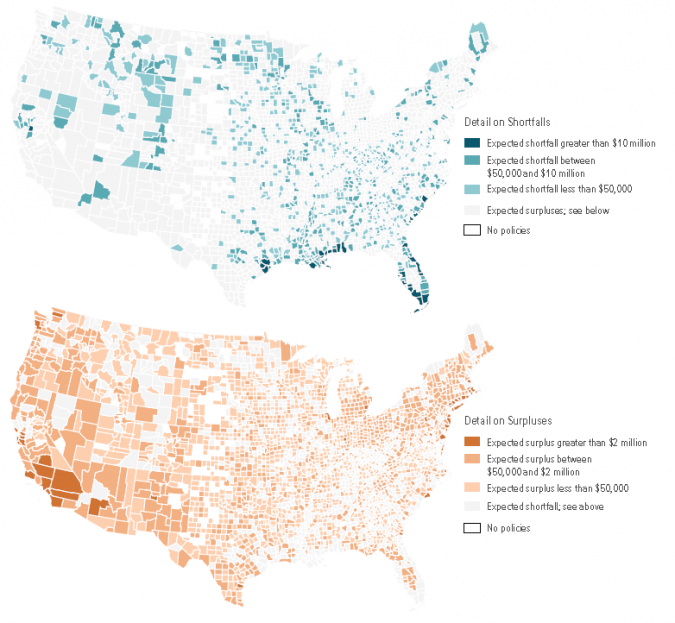

- In October 2017, the Additional Supplemental Appropriations for Disaster Relief Requirements Act canceled $16 billion of NFIP’s debt to enable FEMA to pay these estimated claims. Actual claims from Harvey, Irma and Maria came in at less than 40% of estimate. In 2019 FEMA’s debt stands at approximatwely $20.5 billion. According to the CBO, annual claims exceed premiums by $1.4B per year.

In 2017, the Government Accountability Office (GAO) reported: "Emphasizing affordability has led to premium rates that in many cases do not reflect the full risk of loss and produce insufficient premiums to pay for claims. In turn, this has transferred some of the financial burden of flood risk from individual property owners to taxpayers as a whole."

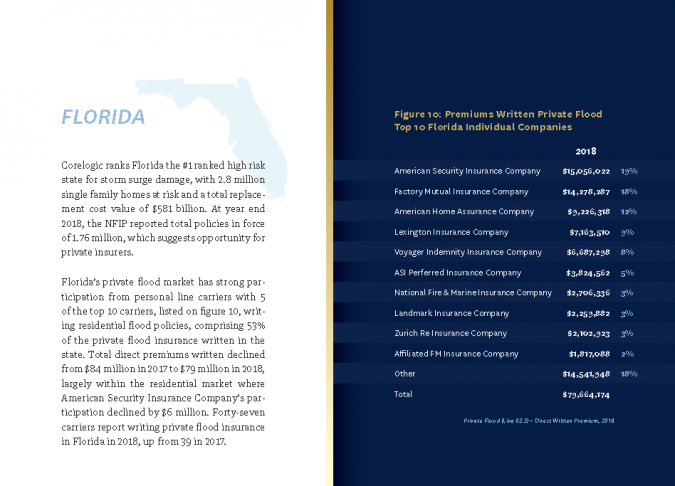

In July 2018 the University of Pennsylvania Wharton School of Business published a comprehensive report on the Emerging Private Residential Flood Insurance Market in the United States wih a separate report on the state of Private Residential Flood Insurance in Florida. Throughout the reports it is clearly noted that subsidized NFIP policies are significantly disconnected from the associated flood risk of the property and frequently provide a regressive benefit to higher-value property owners that would not occur in the private market.

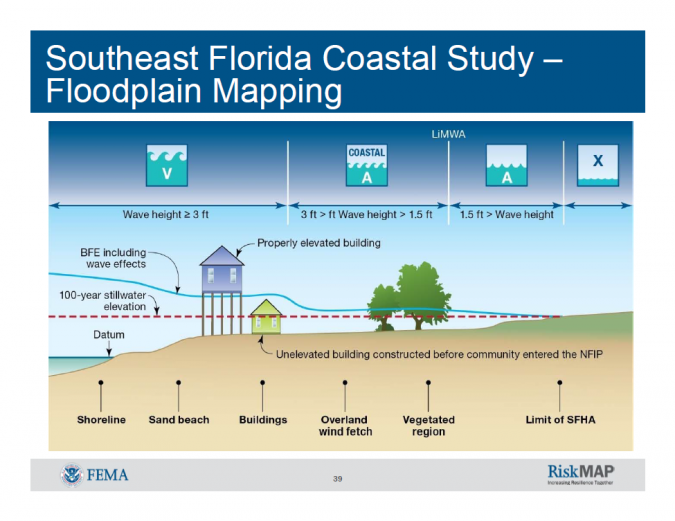

The #2 Problem is Mapping

Funding for mapping is approximately 1.6% of the FEMA budget. Considering that accurate risk-based premiums stem from accurate mapping, this is peanuts. H.R.3167, unanimously passed through House Financial Services Committee on June 13, 2019, proposes to increase the mapping budget by $500M per year for five years.

Maria Cox Lamm, South Carolina NFIP state coordinator chair, speaking for the Association of State Floodplain Managers, testified before Congress in March 2019 that flood risk maps currently only exist for about one-third of the nation; e.g., only 1.2 million of 3.5 million miles of streams, rivers, and coastlines have been mapped.

“Floodplain mapping is the foundation of all flood risk reduction efforts, including design and location of transportation and other infrastructure essential to support businesses and the nation’s economy,” Lamm said. Flood maps are also used for emergency warning and evacuation, community planning, and locating critical facilities like hospitals and emergency shelters.

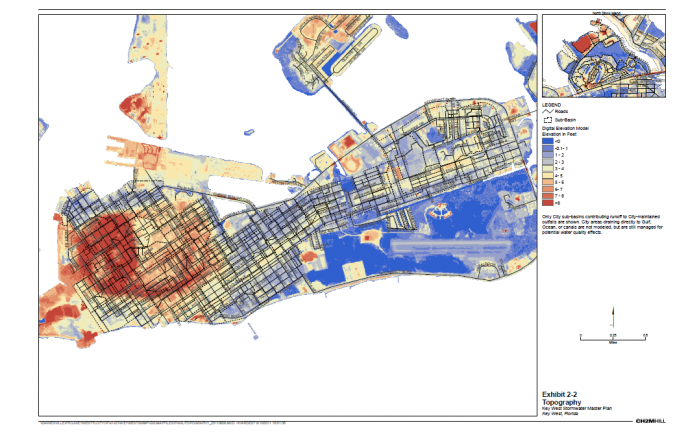

Flood plain mapping for all of Key West is well out of date but getting better. Current flood maps for Key West date to February 2005. New flood plain maps are due from FEMA in Fall 2019 - Spring 2020..

The #3 Problem is Mitigation

By every measure, investments in mitigation provide enormous dividends in safety to community, persons and property and are exponentially less costly than the costs of flood claims. Yet, as with mapping, spending on promotion for and actual mitigation is barely 1.5% of the FEMA budget.

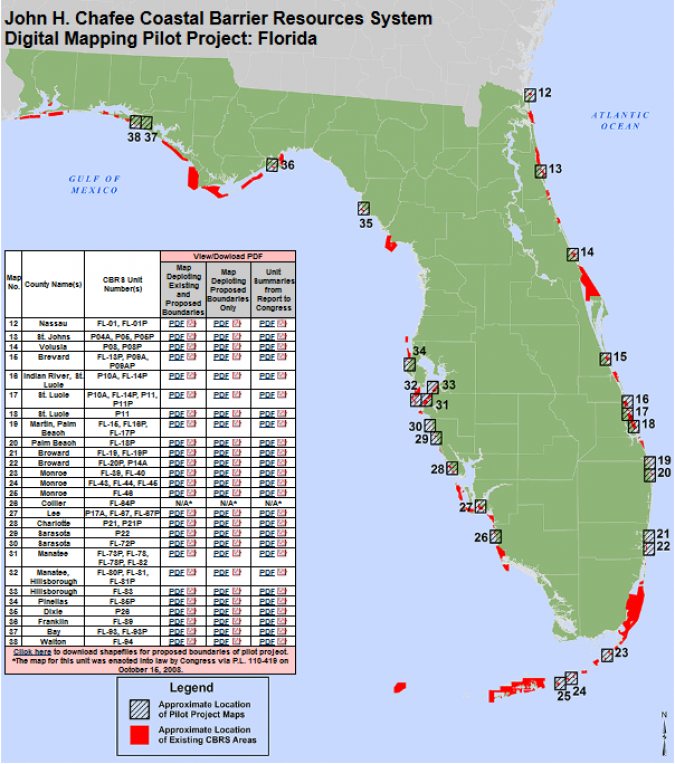

The best mitigation is not to build in flood prone areas. Much of this can be seen in policies surrounding the establishment of the Coastal Barrier Resources System, Florida's Coastal Construction Control Line and to a lesser extent FEMA's designations within the Special Flood Hazard Areas.

Yet, from R.L. Lehmann, Director of Finance, Insurance and Trade Policy and co-founder of think tank R Street Institute; “While NFIP has provided incentives for mitigation, these have not gone far enough, and the availability of cheap flood insurance has played a role encouraging people to build in flood-prone regions.”

By and large, property mitigation occurs AFTER a major flood event, AFTER the property has received significant damage, AFTER the property owner has suffered major out-of-pocket losses and AFTER the property owner receives a low interest reconstruction loan from FEMA.

Solutions

First and foremost, NFIP needs to get out of the Property and Casualty business. The government does not insure my Life, my Business or my Car. There is no reason for the government to be insuring my home. Initiate in phases -

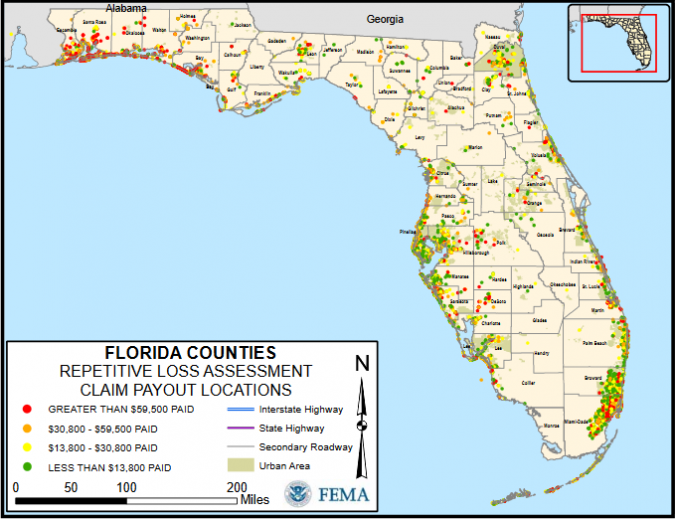

- Remove all repetitive claim properties from NFIP. In Florida, repetitive claim properties account for as little as one percent of the program’s policyholders but 25 to 30 percent of its claims. Flood insurance does not stop repetitive losses.

- Make mitigation work. Only 20% of the 30,000 severe repetitive loss properties nationwide have received federal financial assistance to reduce the overall risk of flood damage; namely, elevation of house, raising foundations, or relocation. Of those 20%, less than half have received buyouts sufficient to enable them to move to higher ground. It is a smarter and more efficient use of funds (and better for the community and the property owner) to get repetitive loss properties entirely out of harms way then to keep paying their claims.

- Mapping. Without an accurate map, you can't get there from here. Along with mitigation, mapping should be at the core of NFIP. NFIP mapping should provide the standardized and routinely updated foundation for private sector use in policy and payment strategies.

Conclusion

Not every one size fits all. A casual look at the map of surpluses and losses shows clearly that NFIP is both unduly fair and unduly unfair. NFIP has served its purpose but is no longer needed. Sufficient private sector insurance and re-insurance companies are available to write and administer policies, calculate premiums and balance payouts. In fact, a flood insurance policy written by a private company and tailored for your property could very likely produce lower premiums than NFIP.

Buying a house and making it your home is a personal decision based on many actual and intrinsic factors. The need for specialized advice has never been greater as property owners grapple with the increasing complexity and range of home versus flood options. Politicians and their collaborateurs are not the source for this advice.

If you have any comments and questions, please contact me here.

Good luck!

Additional Sources: