Flood Insurance in Monroe County, the Florida Keys and Key West is full speed ahead for 2022. FEMA, NFIP Risk Rating 2.0, the US Army Corps of Engineers, the Florida Department of Transportation and community activism are all bringing Flood Insurance to the forefront. Floodproofing and their costs focus on four key points - Continuity of transportation and evacuation, securing critical public infrastructure, protection of private property and ensuring public safety. As these four areas merge the two biggest questions will be - is the public ready to pay the toll and is now the time for private flood insurance companies to enter Monroe County?

How Did We Get Here

A brief review of the previous ten articles -

- Is Your Flood Insurance Going Up - Part X (February 2020) - New Draft Flood maps are out. What do I do now?

- Is Your Flood Insurance Going Up - Part IX (June 2019) - A review of the three largest roadblocks to viable flood insurance; affordability, mapping and mitigation.

- Is Your Flood Insurance Going Up - Part VIII (May 2018) - New elements of the projected bill including "inland storm surge", new mapping techniques and grandfathering.

- Is Your Flood Insurance Going Up - Part VII (August 2017) - Review of the new, bipartisan Senate bill called "The Sustainable, Affordable, Fair and Efficient National Flood Insurance Program Reauthorization Act (SAFE NFIP) 2017.

- Is your Flood Insurance Going Up - Part VI (June 2016) - Update of the FEMA RiskMap mapping project begun in 2013.

- Is Your Flood Insurance Going Up - Part V (July 2014) - Details of the FEMA mapping effort for the Keys and South Florida including an extensive Outreach Program.

- Is Your Flood Insurance Going Up - Part IV (March 2014) - Recap of the March 2014 Homeowners Flood Insurance Affordability Act (HFIAA).

- Is Your Flood Insurance Going Up - Part III (October 2013) - Realization by politicians, including a co-author of flood insurance legislation called the Biggerts Waters Insurance Reform Act of 2012 (BW-12), that BW-12 was causing the consumer more harm than good, aka "unintended consequences".

- Is Your Flood Insurance Going Up - Part II (September 2013) - Treatment of historic buildings, second homes, businesses and no more exemptions under BW-12.

- Is Your Flood Insurance Going Up - Part I (January 2013) - Flood insurance rate changes and their justifications according to BW-12; i.e., refund the bankrupt NFIP.

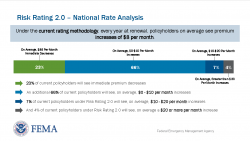

Risk Rating 2.0

Risk Rating 2.0 is not just a minor improvement, but a transformational leap forward. Risk Rating 2.0 does not use flood zones to determine flood risk. Risk Rating 2.0 enables FEMA to set property specific rates that are significantly more fair and ensures both rate increases and decreases are equitable.

Risk Rating 2.0 incorporates more flood risk variables. These include flood frequency, multiple flood types; river overflow, storm surge, coastal erosion and heavy rainfall and distance to a water source along with property characteristics such as elevation and the cost to rebuild.

Meanwhile FEMA is maintaining and complying with existing statutes:

- Most rates do not increase more than 18% per year.

- FEMA will continue to offer premium discounts for pre-FIRM subsidized and newly mapped properties.

- Policyholders will still be able to transfer their discount to a new owner by assigning their flood insurance policy when their property changes ownership.

- Discounts to policyholders in communities who participate in the Community Rating System will continue. (Unincorporated Monroe County presently has a CRS Class 4 Rating. By April 1, 2022, Monroe County is expected to receive a CRS Class 3 Rating which means most of the nearly 14,400 NFIP policyholders in unincorporated Monroe County are expected to receive CRS premium discounts of 35%. Of the 1,700 participating communities nationwide, only 14 communities rank Class 3 or better. Well done Monroe County.)

What about premiums?

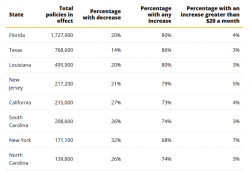

There are nearly 5 million NFIP flood policies nationwide. Risk Rating 2.0 will result in immediate cost reductions for 23% of these policies. The remaining 3.8 million policies will see rates increase; however, it is estimated that just 4% of existing policies across the U.S. will have the highest rate hike. These 4% are concentrated predominantly in Florida, Texas, Louisiana, New Jersey and New York.

In Florida, which has more than twice as many policies as any other state, 20% of its policy holders will have a rate decrease with Risk Rating 2.0 and 80% willl have a rate increase. Only 4% of Florida's 1.7 million policy holders will have a premium increase of more than $20 per month.

Monroe County

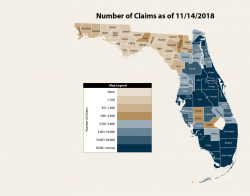

Of Monroe County's approximately 30,800 policies, 9% are expected to see a rate decrease and 91% are expected to see a rate increase. Five percent may have a rate decrease by more than $20 per month and 15% may have a rate increase by more than $20 per month.

By comparison, Miami/Dade County has approximately 347,000 policy holders. Of these, 22% may experience a rate decrease and 78% may experience a rate increase. Three percent may have a rate decrease by more than $20 and 5% may have a rate increase by more than $20 per month.

NFIP Limitations

As a national program, there are some significant limitations to a NFIP flood policy:

- NFIP normally carries a 30-day waiting period before it takes effect.

- Private flood coverage carries a shorter waiting period of 10 to 14 days before it goes into effect.

- NFIP limits dwelling coverage up to $250,000 and $100,000 of coverage for contents.

- Private flood insurance usually allows much higher limits of protection, in particular for personal and high value possessions.

- NFIP does not pay for living expenses, hotel, relocation to an apartment, etc., if you property is uninhabitable. NFIP also does not pay for business loss such as from a home-based business.

- Private flood insurance can pay for living expenses in the event your home becomes uninhabitable as well as business loss.

- For those home owners using a mortgage, private flood insurance must provide at least the same coverage available through an NFIP-backed program in order to satisfy lender requirements.

What does the National Association of Realtors say about Risk Rating 2.0?

National Association of Realtors (NAR) policy supports Risk Rating 2.0: Equity in Action.and wisely acknowledges that Risk Rating 2.0 uncovers and removes previous subsidy policies and preferences.

In fact, following the Biggert-Waters Flood Insurance Reform Act of 2012 (BW-12), NAR formed a member insurance committee to investigate the sudden and excessive rate hikes of BW-12. NAR collaborated directly with FEMA in the development of the new Risk Rating 2.0 methodology. Risk Rating 2.0 is the culmination of thousands of NAR member hours and research dollars.

What about property values? NAR aknowledges that property values may increase or decrease but the benefit to all is that the better information from Risk Rating 2.0 allows for the making of better decisions. From these better decisions will come a more resilient and durable market place with property owners who are more capable of withstanding the shocks that come from coastal storms, flash floods and rising sea levels.

Conclusion

For years the primary focus of NFIP was politically manufactured "affordable" premiums. The result was low value properties were clearly subsidizing high value properties with the net result being an insolvent NFIP ($24 Billion in debt and rising).

As high value areas now see their premiums rising to meet risk, these owners are now claiming foul though in truth, as NFIP premiums are balanced to risk, private flood insurance companies will see the door open to their policies with the likely result being a more honest and open market for home owner and policy provider.

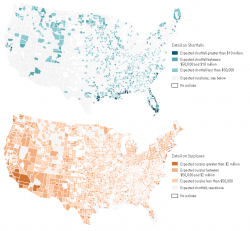

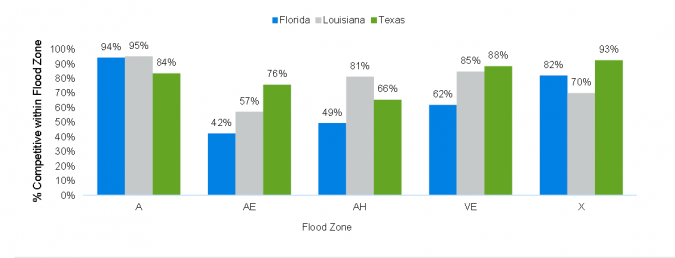

Could private insurance be cheaper than NFIP? Based on an extensive study by Seattle, WA based Milliman of the three biggest flood claimants; Florida, Louisiana and Texas, single family homes using private flood insurance instead of NFIP could experience lower premiums in 77% of single family homes in Florida, 69% in Louisiana and 92% in Texas.

Maybe it is time to think about sunsetting NFIP.

If you have any comments or questions, please contact me here.

Good luck!

Additional Resources: