What if you could quite literally change a student's life? No fooling - Change A Life! What if filling out a simple online form - easier than Amazon prime - could uplift a student and launch them into a LIFETIME of achievement. What if this online form COST YOU NOTHING. ZERO COSTS to you or your business. All fully sanctioned by the Florida Legislature and the Florida Department of Revenue. A for-real opportunity for you to help solve a child's schooling problem. To help reduce a parent's anxiety about their child going to school. To help open a child's ears and eyes to the life long joy of learning! Let's Do It!

In the beginning ...

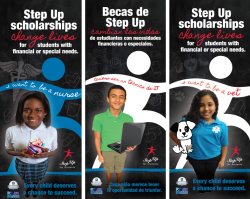

In 2018, the Florida Legislature passed Florida Law HB 7055. This law allows for the redirection of the state Sales and Use Tax on commercial leases away from the General Fund to a state-approved non-profit Scholarship Funding Organization (SFO). The SFO uses the redirected taxes to provide Florida Tax Credit (FTC) Scholarships directly to low income K-12 students. The largest and only state-wide SFO is Step Up for Students (www.stepupforstudents.org). For example:

The average annual cost of a K-12 Scholarship is $6600.

When a business rents space from a commercial property owner (or even if a business rents back from itself), Florida charges a 5.7% Sales and Use Tax on that lease contract. Suppose the rent on a commercial space is $3000 per month, or $36,000 per year. 5.7% of $36,000 is $2052. Presently that $2052 is paid to the Department of Revenue (DOR) which sends the $2052 to the General Fund. HB 7055 allows the business renter to “redirect” that $2052 away from the General Fund to a SFO of the renter’s choice. Here is the process:

How Simple Is It?

The process to apply for credits and make payments is simple:

Fill out the online application, including the Name of Eligible Non-Profit Funding Organization and Planned Contribution Amount. This dollar ($) amount can be up to 100% of your projected annual tax due. (For instance - $2052).

- Upon completion of the online form, the Florida Department of Revenue will send a letter to you authorizing the dollar amount you can contribute to the nonprofit-funding organization.

- When the tax is due, the renter sends the tax dollar amount ($2052/12 = $171) directly to Step Up For Students.

- Step Up For Students sends a letter back to the renter (also to the owner if pre- arranged) acknowledging receipt of payment.

- The renter gives a copy of the receipt of payment letter from Step Up For Students to the property owner.

- The property owner submits that receipt of payment letter to the Florida Department of Revenue when they submit their taxes.

- The Florida Department of Revenue sends a letter to the landlord acknowledging the Sales and Use Tax as paid.

All Done.

In Key West, one hundred and fourteen K-12 students from three schools; The Basilica School at St. Mary's, the Montessori Children's School and the Grace Lutheran School, are receiving scholarships from Step Up For Sudents. One hundred and fourteen is approximately 25% of the students who attend these three schools!

In addition to FTC Scholarships, Step Up For Students provides scholarships for those who are mentally or physically challenged, who have witnessed or been victims of bullying or violence and finally for those younger 3rd and 5th Grade students who have difficulty reading.

Conclusion

Step Up For Students came to Key West in May 2019 and presented at the Key West Association of Realtors, a joint session for The City of Key West and the Key West Chamber of Commerce and a joint session for the three schools which presently have students receiving a Step Up scholarship.

An interesting item presented during this May visit was, a first-of-its-kind study on the long-term effects of the FTC scholarship program. The study by the Urban Institute found that FTC scholarship students are up to 43 percent more likely to go to college and up to 29 percent more likely to earn an associate's degree than their peers. Proof positive!

I have copies of the online application form and relative tax form information in .pdf that I can email to you. Please contact me to receive them.

If you have any comments or questions, please contact me here.

Good luck!