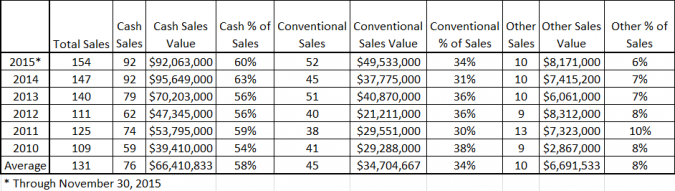

Cash purchases in the Old Town area of Key West from January 1, 2010 to November 30, 2015 have averaged 58% of all sales, from a low of 54% in 2010 to a high of 63% in 2014. The price range of homes sold runs the entire spectrum, from a few hundred thousands of dollars to multi millions of dollars. Buyers too run the spectrum, from those buying replacement property as part of a 1031 Exchange, to those cashing out of a rising stock market, to self-employed, to those who sold their homestead "Up North" and are relocating to Key West.

What are some of the advantages of making a cash purchase on a house?

Mortgage. When buying with cash, the purchase price of the house is the purchase price of the house. No interest is paid due to the cost of borrowing. As an example.

- Assume a purchase price of $895,000, 20% down and finance the balance for 15 years at the rate of 3.2%. Total payments would equal $902,471. Add back the down payment of $179,000 for a total purchase price of $1,081,471 or 21% above sale price due to borrowing.

- Same scenario for 30 years at 3.95%. Total payments would equal $1,223,167. Add back the down payment of $179,000 for a total purchase price of $1,402,67 or 57% above sale price due to borrowing.

Insurance. Mortgages come with insurance requirements set by the lender. In Key West, in fact pretty much all of the Florida Keys, three types of insurance are required by lenders; homeowners (fire), windstorm (hurricane) and flood. Each policy is separate and distinct from the other. Do not expect one to act as a backstop for the other.

Windstorm can be mitigated in numerous way, all dealing with the physical construct of the house; i.e., type of roof and roof strengthening through the use of straps and tie-downs, storm-proof windows, doors and shutters, etc. Each of these mitigations can reduce premiums.

Flood premiums are more determined by geographic location and flood zones detemined by mapping from FEMA. A lender might not require Flood insurance if the property is situated on a higher elevation. Premiums can also be lowered if the property has been raised high enough above ground level.

Ultimately, if you do not have a mortgage you have the option to forego windstorm and flood insurance. Additionally, exceedingly high deductibles for both windstorm and flood insurances cause many people in the Keys who own their property outright to "self insure".

Cash offers can control the sale.

During the initial offer/counter-offer phase, Cash Buyers wish to eliminate as many contingencies as possible in order to be competitive. This is especially important in a reduced inventory environment when "more" buyers are competing for "few" properties. Second, cash buyers also favor the more streamlined, time-saving process of reducing lender paperwork and administration.

Third, and perhaps even more critical, cash buyers, through their offer, can assign an emotional value (goodwill if you please), that a lender might not incorporate into their predominantly market and appraisal oriented valuation process. There's nothing more de-railing than a property that doesn't appraise - something a cash buyer (and seller) does not have to worry about.

Conclusion

As you can see from the image, the number of cash sales, cash sales value and cash % of sales, all values through November 30, 2015, are very close to the full year values for 2014.

This relatively flat nature of cash sales matches very closely to the overall sales picture for homes in Old Town as reported in my blog for the end of November. Old Town sales, which have been hitting on all 8 cylinders since 2010, have also slowed some in 2015. Maybe it's time for a pit stop.

If you have any coments or questions you can contact me here.

Good luck!