Who needs flood insurance? There haven't been any hurricanes or heavy flooding since - 2005! Why bother right!? Don't be fooled. Regardless of storm predictions season to season, the need for flood insurance for Key West and the Florida Keys will never disappear. FEMA, through their contractor Taylor Enginering is 2 years through a five year project called RiskMAP to identify, assess, and reduce our flood risk. Map completion is estimated for 2019. Throughout this timeframe, FEMA will provide face-to-face community follow-up as part of their outreach, education program so we "don't get fooled again". What is the progress to date?

Background

My first five blogs on this subject covered the legislative steps and missteps to craft the ways and means to regulate and pay for flood insurance - primarily through the National Flood Insurance Program. Recapping quickly:

- Is Your Flood Insurance Going Up - Part V - Details of the FEMA mapping effort for the Keys and South Florida including an extensive Outreach Program.

- Is Your Flood Insurance Going Up - Part IV - A recap of the March 2014 Homeowners Flood Insurance Affordability Act (HFIAA).

- Is Your Flood Insurance Going Up - Part III - Realization by politicians, including a co-author of flood insurance legislation called the Biggerts Waters Insurance Reform Act of 2012 (BW-12), that BW-12 was causing the consumer more harm than good, aka "unintended consequences".

- Is Your Flood Insurance Going Up - Part II - Treatment of historic buildings, second homes, businesses and no more exemptions under BW-12.

- Is Your Flood Insurance Going Up - Part I - Flood insurance rate changes and their justifications according to BW-12; i.e., refund the bankrupt NFIP.

In Fiscal Year 2013, FEMA initiated a coastal flood risk study for the South Florida Study Area that affects Broward, Miami-Dade, Monroe, and Palm Beach Counties. The results of that study will be incorporated into updated digital Flood Insurance Rate Maps (FIRMs) and Flood Insurance Study (FIS) reports for these counties.

See Region IV Coastal and Mapping Analysis for information about the South Florida RiskMAP study.

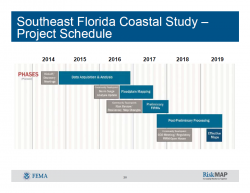

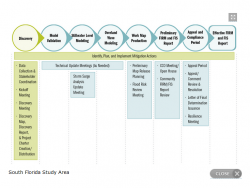

This RiskMAP project is broken down into five broad and engineering intensive sections; Discovery, Modeling, Map Production, Preliminary Report and Appeal and Final Report.

As shown in this schedule graphic, RiskMAP is presently in the Discovery Phase (green in color). Likely the most tedious yet important phase, Discovery includes collecting minute, property specific information that allows for an exceedingly comprehensive understanding of flood risk and flood mitigation capabilities within our area. Second, Discovery includes a conversation about the process with area residents - the initial conversation having occured July 2014 at the Harvey Government Building. Click here for my report on this important kick off meeting.

How You Should Use the New Flood Hazard Maps Once They Are Completed

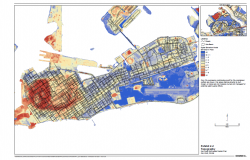

Preliminary information from flood mapping already completed outside of Monroe County indicates more properties have been moved out of high risk areas, called Special Flood Hazard Area (SFHA), then have been moved in to high risk areas.

Even so, Key West will likely see a 1' increase in our Base Flood Elevation (BFE). The area most likely affected will be the inland AE zones, where to date most flood claims have originated.

But here is something very important to consider -

Some properties presently mapped as being in a low- or moderate-risk area (Zone B, Zone AE, or Zone X) on the existing Flood insurance Rate Map (FIRM) might show up in a high-risk zone on the updated Flood map.

If the new flood map moves your property in to an SFHA, and you purchased flood insurance BEFORE the new flood map became effective, you may be able to obtain a LOWER flood insurance premium rate than if you wait until after the flood map becomes effective. Therefore, you should discuss the benefits of purchasing a flood insurance policy now with your insurance agent or company.

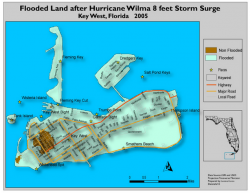

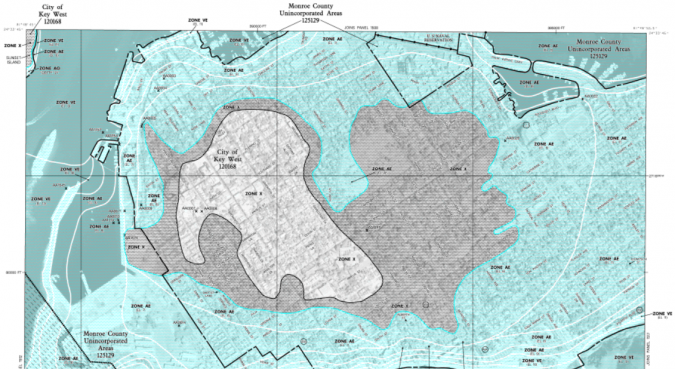

You can view where your property presently exists by accessing FEMA's National Flood Hazard Layer which uses the latest map, dated February 2005, to display properties.

- Type in your street and city address

- Your property will be shown in its existing flood plain.

- The Legend to the left provides some color coded definitions.

Summary

So, where does this leave us? No changes until at least 2018/2019. But, if you are building or remodeling your home, be sure to include flood plain concerns in your planning.

The FEMA Coordinator for Key West is Scott Fraser. Contact Mr. Fraser at sfraser@cityofkeywest-fl.gov. Scott maintains an excellent City of Key West Floodplain Management web page full of flood related information, including building obligations and how to obtain a Flood Certificate.

If you have any comments or questions, please contact me here.

Good luck.

Additional Resources: