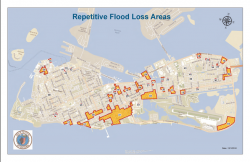

You have decided to use wet floodproofing to mitigate the effects of flooding on your Key West home, or to use dry floodproofing on your business, or you have decided to sell your home and are seeking a way for FEMA to buy your property outright, aka voluntary buyout. You know FEMA is budgetted to assist in these tasks but you do not know how to get started. What is the process? Are you eligible? What are the caps on financial assistance? Do you have to wait for flood damage before financing is available or can you mitigate the effects proactively, before flooding occurs? Let's find out.

Mitigation

As I noted in my 10th article on Flood Insurance; there are three priorities to combat flooding; mitigation, land use and buyout. Land use is the responsibility of the local city or county. Mitigation and buyout is the responsibility and option of the property owner.

All signs point to an increase in your flood insurance premium. New FEMA Draft Flood Maps for Key West and Monroe County are on the horizon and it is time to get serious about keeping flood insurance premiums under control. Much like windstorm insurance, there are ways to mitigate the rise in flood insurance premiums. Now is the time to take action. The investment is well worth the effort. By 7:1, every $1 spent in mitigation yields $7 in savings.

There are two types of property mitigation; wet floodproofing for residencial property and dry floodproofing for commercial property. In Monroe County, wet floodproofing is limited to elevating your home above base flood elevation.

Mitigation - Get Started

Mitigation Reconstruction is one of the eligible projects under the FEMA Hazard Mitigation Grant Program (HMGP) and is the construction of an improved, elevated building on the same site where an existing building and/or foundation has been partially or completely demolished or destroyed. Keys items of this Grant are:

- The Federal share of the Construction costs are limited to a $150,000.

- Costs, such as permitting and design can be covered with a 75% Federal share.

- The square footage (SF) of the resulting finished structure shall be no more than 10 percent greater than that of the original structure.

- No construction may begin prior to the award of the grant.

Homeowners who want to participate in this program make application to Monroe County, who makes application to the State, who makes application to FEMA, who replies to the State, who replies to the County, who replies to the homeowner.

Homeowners who proactively want to elevate their property before their property has been damaged or destroyed by flooding are eligble for the Pre-Disaster Mitigation Program (PDM). This program reduces risk to neighborhoods and structures from future flood events. It also reduces repeated reliance on federal funding in future disasters. PDM grants are funded annually by Congress and are awarded on a nationally competitive basis.

At present there are no online applications for the pre-disaster program and applications for the post-disaster program associated with Hurricane Irma are closed out. Forms for online distribution are currently under review and should be available before the next hurricane season.

Meanwhile, homeowners who want to participate in the pre-disaster or post-disaster grant programs in Monroe County may begin the application and information process by emailing the Chief of Floodplain Regulatory Operations, Karl Bursa at bursa-karl@monroecounty-fl.gov.

Property Acquisitions for Open Space - Buyout

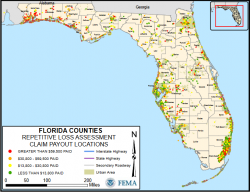

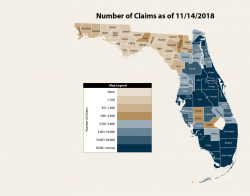

Only the owner of a property in a repetitive flood-prone area can make the decision to participate in a FEMA acquisition/buyout program. There are two FEMA acquisition programs:

- Property acquisition and structure demolition leaving the property permanently unbuildable

- Property acquisition and structure relocation

FEMA does not buy houses directly from homeowners. Buyout programs are administered by the local emergency management agency using grant funding support from FEMA. In the Florida Keys and Key West this is the Monroe County Voluntary Home Buyout Program. Participation in this buyout program is completely voluntary; no homeowner is required to sell their property or is forced to move because their home is located in an area subject to repetitive flooding. Homeowners whose property is in a repetitive flood area who want to sell their home prior to the damage or destruction of their home are not eligible for this Buyout Program.

The good news is Monroe County has received $15M from HUD to buyout approximately 60 homes damaged or destroyed by Hurricane Irma - so there is a successful process in place.

Homes that are determined to be eligible for buyouts are purchased by Monroe County at the fair market value of the property prior to the flood. The fair market value is determined by a certified appraiser using sales of comparable homes sold before the flood. Homeowners who disagree with the appraisal have the right to appeal within 30 days.

Any debt connected to the property must be paid off and if not, the amount of that debt is deducted from the amount paid to the property owner before the transfer to the local purchasing authority is complete.

Buyout - Get Started

The Rebuild Florida Voluntary Home Buyout Progrm (this one specifically for Hurricane Irma) is governed by the Florida Department of Economic Opportunity. As with mitigation, the buyout program is administered at the city/county level.

I searched high and low in Key West, Monroe County and Florida's Department of Economic Opportunity (DEO) for information on how a homeowner can proactively sell their property through the Buyout Program. Every source stated that a homeowner can only participate in the Buyout Program AFTER their home has been damaged or destroyed. As far as I can tell, homeowners who want to remove proactively their property from the floodplain records can not do so through any current Federal program. Why no pre-disaster buyout program? Unknown.

To receive more information about how you can participate in Florida's Buyout program, including notifying the County of your desire to sell your property proactively before a disaster, please contact:

- Monroe County:

- Helene Wetherington, Disaster Recovery Director

- Wetherington-Helene@monroecounty-fl.gov

- 305-504-3036

2. Islamorada:

- Mary Swaney, Assistant to the Village Manager/PIO

- Mary.Swaney@islamorada.fl.us

- 305-664-6411

3. Marathon:

- George Garrett

- garrettg@ci.marathon.fl.us

- 305-743-0033

4. Key West

- Alison Higgins

- ahiggins@cityofkeywest-fl.gov

- 305-809-3726

You will probably hear that Buyouts are only made available after a flood disaster and the issuance of a Declaration of Disaster of some sort. No problem. If you want to participate in a Buyout program, before or after a disaster, then still contact the above representatives and express IN WRITING your desire for a Buyout. If enough homeowners make enough noise then maybe the County and State will be able to present their case to FEMA about the benefits of a proactive Voluntary Buyout program much like the pre-disaster mitigation program. Don't give up.

Remember the ole Navy maxim - the squeeky wheel gets greased.

Commercial Mitigation

I could find only one reasonable source for Floodproofing Non-Residential Buildings and FEMA's financial assistance.

Read Appendix A, page 153, for details; specifically, FEMA assistance is available to help property owners of non-residential buildings to implement flood retrofitting projects. The sources of the assistance are the Increased Cost of Compliance (ICC) coverage in Standard Flood Insurance Policies from the National Flood Insurance Program (NFIP).

The building must have substantial or repetitive flood damage to be eligible for ICC funds. ICC coverage can be used for elevating, relocating, demolishing, or floodproofing a non-residential building.

Conclusion

As President Kennedy stated in his first State of the Union address (select page 8) to Congress in January 1962, "The time to repair the roof is when the sun is shining". To me, that's better than waiting for a tragedy to manufacture an opportunity.

Monroe County is doing everything it can to optimize the flood plain management of the County. This is done through a FEMA NFIP Community Rating System (CRS) that can reduce premiums by 5% to 45%. Over the past five years, the county's efforts to improve the Community Rating System of Monroe County and Key West has resulted in a savings of $19M to flood insurance policy holders. Well Done!

Now is the time for individual property owners to do their part to reduce their flood insurance premiums and vulnerability to a flood disaster. Let's face it. We ALL live in a flood prone area, some just more than others. By taking the initiative to best mitigate our properties from flood damage, or sell them via a Buyout Program, we benefit ourselves and our neighbors. Do you really want to go through another flood disaster?!

Final note: Be persistent. Be patient. Everyone will tell you these programs can take years to resolve. Very true. There are mountains of red tape and barrels of administrative delays. Get everything in writing and keep good records.

If you have any comments or questions, please contact me here.

Good luck!

Additional Resources: