In July 2012 the Surface Transportation Bill (H.R. 4348) was signed. Inside this Bill was the Biggert-Waters Insurance Reform Act of 2012 (BW-12). Among the key features of BW-12 is an insurance rate schedule that seeks to return the bankrupt National Flood Insurance Program (NFIP) to solvency as soon as possible. For many property owners, rate hikes of 25% went into effect this October 1, 2013. Even properties built within FEMA compliance are effected. What have our professional groups and politicians been doing since July 2012 to delay or reverse BW-12? Waiting for a crisis. What are they doing now? Wringing their hands.

In January and again in September, I wrote about the Biggert-Waters Flood Insurance Reform Act of 2012 (BW-12). January provided the background of the legislation that is bringing these rate increases, discussed treatment of pre-1975 and grandfathered properties and provided the key elements of the revised Premium Rate Structure Reforms.

September's update spotlighted the treatment of historic buildings, residency requirements and legislative efforts to delay or reverse the rate increases including those by our own Representative Joe Garcia.

On September 30, 2013, the day before BW-12 went into effect, one of the two authors of this legislation, Rep. Maxine Waters, (Rep. Judy Biggert was the other author) issued a statement expressing her "outrage" over the rate increases caused by her/their own legislation. A summary of her statement can be read here.

On June 5, 2013 the House of Representatives passed an amendment to the FY 2014 Homeland Security Appropriations Act to shield certain flood insurance policyholders from excessive rate increases. Despite broad support from House Democrats and Republicans, the Senate has not acted on this amendment.

Following the passage of the House amendment, Rep. Waters spoke on the House floor: "This law (BW-12) was intended to reauthorize the flood insurance program in a sustainable way. The intent was not to impose punitive or unaffordable rate hikes that could make it difficult for some to remain in their homes. This is why I am extremely concerned about reports that homeowners in certain areas are facing high and unsustainable flood insurance rates."

Ms. Biggert was the former Chairwoman of the Subcommittee on Insurance, Housing and Community Opportunity and is no longer in Congress. Rep. Waters is the ranking Democratic member of the House Financial Services Committee.

You'd think these people would know better.

On September 27, 2013 a letter was sent from seventh-three Democrats and Republicans of the House to the leaders of the House of Representatives; Rep. John Boehner and Rep. Nancy Pelosi, urging them to include language from the June 5 amendment "... to any appropriate legislative vehicle used to complete the appropriation process for the 2014 fiscal year". (This is because of inaction by the Senate.)

The letter also points out that while FEMA has issued new Specific Rate Guidelines that raises rates even on those homes built within (previous) FEMA code, elevation and guidelines, FEMA is years away from conducting the affordability study mandated by the Biggert - Waters Flood Insurance Reform Act of 2012. Take the money now, worry about the impact later, though in (some) fairness FEMA Administrator Craig Fugate states his hands are tied and he must implement BW-12 as written.

Our Representative Joe Garcia is one of the co-signers of this letter, read here, and it is from his Key West office that I received the letter. Thank you.

What do I do NOW?

Two things:

- Get Smarter about your Flood Elevation

- Complain to our Politicians

1. Here's how to Get Smarter about your Base Flood Elevation:

- Go to www.mcpafl.org

- Click on Property Search

- Click on Real Property Search

- Type in Owner's Last Name or your street address

- Click on Search

- At the top of the Property Record Card, is the Parcel ID #. Write it down.

- Go to www.monroecounty-fl.gov

- Click on Residents

- Under County Resources, click on Flood Zone Maps Online

- Click on Find RE Number

- Type in (or copy/paste) the Parcel ID #

- When the next image appears, click on the RE number an Click Zoom to.

- A Map will appear and provide the Flood Zone and Base Elevation as in AE (El 11) or AE Flood Zone Elevation 11'.

If this is too much of a pain in the butt, which it is, call your insurance agent and have them do it!

Addresses of our Politicians

2. Here are the addresses of our Politicians for your complaints:

A. Senator Marco Rubio

284 Russell Senate Office Building

Washington, DC 20510

Ph: 202.224.3041

or

869 NW 36th Street Suite 110

Doral, FL 33166

Ph: 305.418.8553

There is no direct Email available to any politician. To send an email go to their web site and select Contact to Send an Email.

B. Senator Bill Nelson C. Rep. Joe Garcia

716 Hart Senate Office Building 1440 Longworth House Office Bldg

Washington, DC 20510 Washington, DC 20515

Ph: 203.224.5274 Ph: 202.225.2778

OR OR

2925 Salzedo Street 1200 Simonton Street Suite 1-123

Coral Gables, FL 33134 Key West, FL 33040

Ph: 305.536.5999 305.292.4485

www.rubio.senate.gov www.garcia.house.gov

Conclusion

I can not help but wonder where the real estate industry has been these past eighteen months. The passage of BW-12 in July 2012 should have brought an avalanche (tsunami?) of protest. But did not. Where was the National Association of Realtors? Where were the states Association of Realtors? And all those local Political Action Committees? What were they doing?

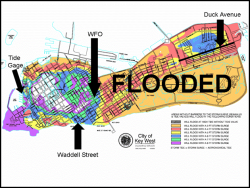

Even those in "safe" X-Flood zones will see rate increases. Everyone's Base Flood Elevation (BFE) is going to increase 1 foot, meaning if you built to the BFE of 8' in your AE8 flood zone, the BFE is now 9' and you are out of compliance.

It's up to US now to ACT. Please. Write. Call. Email.

If you have any comments or questions please contact me here.

Thank you and good luck.

Additional Resources: