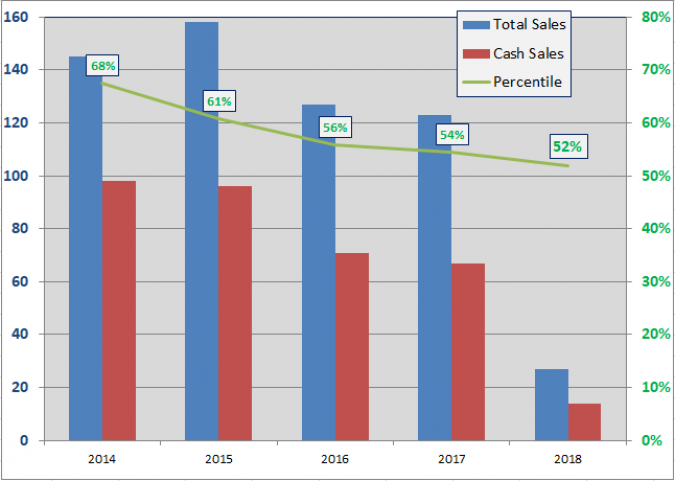

Cash Buyers continue to play a large role in home sales in Old Town Key West. From 2014 through 2017, cash sales accounted for an average of 60% of sales. The national average is 30%. Cash sales for Old Town real estate are not just for inexpensive properties as cash sales prices have ranged from the low $300,000 to $3M+. This is an excellent gauge of the confidence these new home owners have in Key West real estate. Benefits accrue to the buyer, seller and the local market from a cash deal. Let's review a few:

Buying a home in Old Town Key West for Cash can be quite a financial undertaking. In 2016 and 2017 the average sale price for a home in the Old Town area was $1.181M. At sales prices averaging approximately $725 per square foot, buying into an Old Town house is not cheap. Committing a chunk of cash for a 33040 zip code shows a powerful commitment to move from the most liquid asset to nearly the most ill-liquid asset.

There are benefits to everyone from a cash sale. Here are some of them:

Benefits to Buyer

1. No mortgage -

- No qualification limitations; credit scores, income history, asset verification ...

- Lower overall cost of long term ownership

- Quicker closing - sounds good to the seller too

- No administrative fees

- Appraisal - optional

- Inspection - optional

- Title insurance - optional

- Property Insurance(s) - optional

2. Immediate Ownership

- Immediate Equity

- An "unleveraged" property is easier to sell, especially if selling fast or at a loss

Warnings to Buyer

Be forewarned - property rich and cash poor is not a comfortable place to be. How much sense does it make to have to take out a Homeowners Equity Loan to cover unexpected expenses because you tapped out on buying the home in cash.

Second - opportunity cost. In essence, could that chunk of money you put down to buy the home outright be making more money someplace else? Which is wiser -

- 100% cash purchase, or

- 30% down and make accelerated mortgage payments while the other 70% is invested someplace else

Third - No tax advantage from Mortgage Interest Deduction (only advantageous to high mortgage amounts) and No advantage from the effects of Inflation.

Benefits to Seller

1. No mortgage

- A cash sale provides ease of mind that the Buyer is not going to be forced out or have to renegotiate the terms of the Contract because he/she did not qualify for the loan.

- Prior to accepting Buyer's Offer, I would ask for a formal Proof of Funds letter from a legitimate 3rd party; Brokerage, Bank, Credit Union or some other entity who can verify Buyer has funds on hand for the Sale.

2. Accelerated Closing

- If you, the Seller, have your paperwork in order, then the Buyer will be confident enough to Close without undue delay. What does that mean?

Seller Prep

Dear Seller - if you want the Cash Buyer to act promptly you must have your paperwork in order; namely,

- A current Survey; that is, a Survey that incorporates any changes to adjacent property lines since taking ownership of the property being sold.

- A credible and full Seller's Disclosure that covers at a minimum the principle elements of your property; roof, foundation, electrical and plumbing. If Seller provides a wimpy Seller's Disclosure then Buyer may likely require an Inspection.

- In addition to (or as part of) the Seller's Disclosure, a property history showing both Permitted and unpermitted work in such key areas as air conditioning, pool, appliances and other high-value quality of life items.

- Any storms lately? What specifically happened?

Benefit to Market Area

A market area with high property ownership rates; that is, homes actually owned by the owner and not by the bank, has greater strength as the market moves up and greater resilience as the market moves down.

As the market moves up, the home pays for its own improvements without sacrifcing equity. In a rising market, owners of a home owned by the bank often take out a home equity loan to use for non-property purchases. Debt on the home increases. Under similar circumstances, a home owned by the owner suffers only the increased indebtedness of an Equity Loan/Line of Credit.

When the real estate market stumbles, the owner of a home with a mortgage can struggle to make payments as often the surrounding environment suffers as well, jeopardizing job security and income. A home without a mortgage will not suffer this risk, keeping the surrounding environment more secure and stable. An environment with high actual home ownership can more readily survive market downturns.

Conclusion

In the market run-up of 2002 - 2005, a great deal of properties were purchased with the sole purpose of flip and fly. Cash transactions were minimal. Buyers used the bank to buy in and held their cash for the fix-up. The resulting crash left many under capitalized buyers with few options but to cut and run.

Since the Key West real estate market bottomed in 2009/2010, cash purchases of homes have averaged approximately 58%. This buyer confidence, resulting strength of ownership and price stabilization will sustain the Old Town Key West market through any foreseeable downturn.

If you have any comments or questions, please contact me here.

Good luck!

Additional Resources: