With the recent signing of the Homeowners Flood Insurance Affordability Act (HFIAA) by President Obama, the dilemma between property owners paying a higher premium for flood insurance and the re-funding of the National Flood Insurance Program (NFIP), from which flood insurance claims are paid out, has been at least temporarily resolved. Premiums will be paid. Floods will occur. Claims will be made and settled. Flood plain maps will be re-drawn. And NFIP, $24B in debt, will slowly gain solvency as owner premiums cover their risk.

On March 21, 2014, President Obama signed the Homeowners Flood Insurance Affordability Act (HFIAA). This Act delays, reduces and restructures flood insurance rate increases previously designed by the Biggert-Waters Act of 2012 (BW-12). BW-12 went into effect on October 1, 2012. When rates started going up on January 1, 2013, all hell broke loose from property owners, and politicians, many of whom voted for BW-12, have spent the last 14 months urgently crafting a response to fix BW-12.

Details of BW-12 and the "unintended consequences" it created are provided in my three previous blogs:

- Is Your Flood Insurance Going Up - Part I - Flood insurance rate changes and their justifications; i.e., refund the bankrupt NFIP

- Is Your Flood Insurance Going Up - Part I - Treatment of historic buildings, second homes, businesses and no more exemptions

- Is Your Flood Insurance Going Up - Part III - Realization by politicians, including a co-author of BW-12, that BW-12 was completely messed up.

What does the Homeowners Flood Insurance Affordability Act say?

Instead of reviewing the ins and out BW-12 and the separate pieces of legislation crafted by the Senate and House of Representations, I will just tell you what the HFIAA provides. Truth be told, it is a reasonable short term fix, except for one key element which is covered later .

The following items apply to primary residences and primary residences only:

- Rate increases: BW-12 mandated immediate 25% increases per year until the full risk-rate was achieved. HFIAA aims for annual increases of 5% - 15% with a cap at 18%.

- BW-12 required homebuyers to pay the full-risk rate for pre-FIRM properties at the time of purchase. This caused property values to steeply decline and made many homes unsellable. With HFIAA, homebuyers will continue to pay the same flood insurance as the home seller.

- BW-12 terminated grandfathering. HFIAA says, if you were once in compliance with flood maps, then new maps will not push you out of compliance.

- FEMA will refund policyholders who paid premiums in excess of these new required rates.

- Requires FEMA to certify its mapping process is technologically advanced and justifiable. Requires FEMA to send communities being remapped the data being used in the mapping process.

- Compels Congress to provide funding to FEMA so FEMA can reimburse those who successfully challenge FEMA mapping.

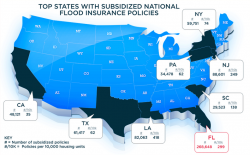

- Charges a $25 surcharge to primary homeowners and $250 surcharge to non-primary homeowners. Surcharges will be placed into a Reserve Fund to pay off NFIP's $24B debt and make it solvent for future flood insurance claims.

- Allows FEMA to go to the private sector re-insurance industry and capital markets to obtain re-insurance of coverage provided by the flood insurance program.

- Requires FEMA to conduct a flood insurance rate affordability impact study with asociated regulations to cover any unaffordability issues. This study was mandated in BW-12.

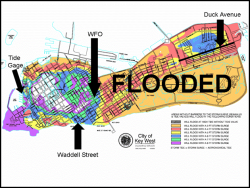

Again; businesses, second homes and investment property, key elements to the real estate industry of many coastal areas, like Key West, are not covered by these HFIAA premium rate changes. These properties can see premium rate increases of up to 25%.

Not everyone is happy.

Conservative and environmental groups lobbied predominantly against provisions of HFIAA. (The insurance industry, who had lobbied for BW-12, largely sat this one out).

Many argue the continued subsidies do not prevent the National Flood Insurance Program, the pot of money from which claims are paid, from going even further into debt, now at $24B. "Reducing rates does not reduce risk. In fact, it reduces incentives to mitigate that risk. While politically expedient today, this abdication of responsibility by Congress is going to come back and bite them and taxpayers when the next disaster strikes," said Steve Ellis, vice president of Taxpayers for Common Sense, a Washington-based watchdog group. "Everyone knows this program is not fiscally sound or even viable in the near term."

Environmentalists argue the continued buildout along coastal and river areas is a threat to the environmental integrity of adjacent waterways and sea life.

The proposed legislation drew fire from the New Jersey Sierra Club. “Some of the leaders (on HFIAA) also are leaders on climate change and sea level rise, however this legislation will undermine those efforts,” said club Director Jeff Tittel.

“This type of legislation is being pushed because of pressure from people who still want flood insurance subsidies and the government to help pay for their beachfront homes. It shows that leaders who care about climate change are not immune to public pressure from constituents who want to have it both ways,” Tittel said.

Conclusion

As compromises go, the HFIAA legislation isn't bad. Premiums do rise and FEMA mapping will be more closely scrutinized. But, subsidies do remain. In fact, the higher the risk area, the greater the subsidy. Some in areas of repetitive losses are even complaining they are not receiving sufficient relief. Does that make sense?

Overall, subsidies distort the true value of the product or service, injuring the customer more than benefitting. Neither auto nor homeowners nor long term care nor life insurances are subsidized. So why flood?.

For me, the solution is a 3 - year phase out of NFIP and turn the entire process over to the insurance industry. The insurance industry is much more qualified to manage flood insurance than the government. Their business models are specifically designed around risk management, competitive premiums and re-insurance.

If you have any comments or questions, please contact me here.

Good luck!

Additional resources