Now that Federal legislation is in place to prevent onerous flood insurance rate increases on primary homeowners in flood prone areas, the task of updating Flood Insurance Rate Maps (FIRM) is underway. The effective date of Key West's FIRM is 2005, from a Datum level dated 1929. The study underway is projected to establish a new FIRM with an effective date of 2019, from a Datum level dated 1988. Throughout the Study, FEMA will employ an aggressive community Outreach Program to exchange information with the public, both sides becoming a partner with the other in this enormously complex social and engineering process.

My first four blogs on this subject covered the legislative steps and missteps to craft the ways and means to regulate and pay for flood insurance - primarily through the National Flood Insurance Program. Recapping quickly:

- Is Your Flood Insurance Going Up - Part IV - A recap of the March 2014 Homeowners Flood Insurance Affordability Act (HFIAA).

- Is Your Flood Insurance Going Up - Part III - Realization by politicians, including a co-author of flood insurance legislation called the Biggerts Waters Insurance Reform Act of 2012 (BW-12), that BW-12 was causing the consumer more harm than good, aka "unintended consequences".

- Is Your Flood Insurance Going Up - Part II - Treatment of historic buildings, second homes, businesses and no more exemptions under BW-12.

- Is Your Flood Insurance Going Up - Part I - Flood insurance rate changes and their justifications according to BW-12; i.e., refund the bankrupt NFIP.

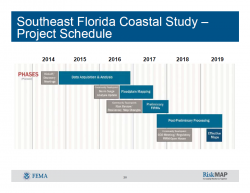

Community Outreach (in grey) at every phase of the Project Schedule.

Among the many mandates inside the Homeowners Flood Insurance Affordability Act (HFIAA) that was signed into law on March 21, 2014 were two key map-related provisions:

- Requires FEMA to certify its mapping process is technologically advanced and justifiable. Requires FEMA to send communities being remapped the data being used in the mapping process.

- Compels Congress to provide funding to FEMA so FEMA can reimburse those who successfully challenge FEMA mapping.

The stated goals then of this Southeast Florida Coastal (FIRM) Study are:

- Determine revised Base Flood Elevations (BFEs) and flood inundation boundaries for 1% annual chance (base) flood total water levels.*

- Update the Coastal Flood Insurance Study (FIS) and Flood Insurance Rate Map (FIRM) panels.

- Assist communities with incorporating this information into risk assessment and hazard mitigation planning.

* Not 1 in a 100 years but anytime a 1% flood event might occur; i.e., high tide Cat II Hurricane, low tide Cat III Hurricane, hurricanes and storms coming from every point on the compass, slow moving, fast moving, concentrated or sloppy, etc., etc.

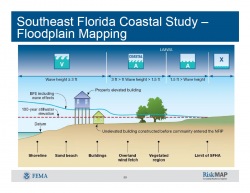

V-zone = waves 3' or more, A Coastal-zone = waves between 1.5' and 3', A-zone = waves up to 1.5' and X-zone = no waves.

On Wednesday, July 23, 2014 at the Harvey Government building in Key West, FL, I attended an open-to-the-public forum that detailed the FIRM mapping process called the Southeast Florida Coastal Study. The two-hour forum was moderated by the lead engineer of the private sector team conducting the Study and while the forum was open to questions, it did not address insurance or property mitigation.

Information about the engineering and social process to accomplish this Study can be explored at www.southeastcoastalmaps.com.

The forum primarily discussed two items:

- The intent of FEMA to give updates and receive pertinent local knowledge about area flooding with the public through an annual, at a minimum, Outreach Program; and,

- The engineering and modeling of data necessary to provide a real-life, site-specific, risk-based flood plain map.

FEMA recognizes that is must rely heavily on local knowledge for accurate topographic and bathymetric mapping. Also too, for public works projects present and intended, seawalls and land walls, buildings, land contours and drainage rates. In minute detail these local attributes of the flood plain are required so the modeling and simulation will result in site-specific, risk-based analysis.

Conclusion

I was very impressed with the coupling of engineering analysis through modeling and simulation with a dynamic social outreach program. The forum was devoid of the hype and unsubstantiated comments that can misdirect best intentions.

If you would like to stay abreast of the Southeast Florida Coastal Study, the easiest way is to contact Fair Insurance Rates in Monore County at firmkeys@gmail.com and to Like them at www.facebook.com/FIRMKeys.

If you have any questions or comments, please contact me here.

Good luck!

Additional resources: