On June 13, 2017, Democratic and Republican Senators representing Massachuettes, New Jersey, Lousiana, Mississipi and Florida held a news conference to outline the results of their lengthy coordinations to fix the damn problem - National Flood Insurance Program is wasteful, abusive to property owners and grossly mismanaged. As Sen. Kennedy of Louisiana stated "The American people deserve a National Flood Insurance Program that looks like somebody designed it on purpose". The new bill is "The Sustainable, Affordable, Fair and Efficient National Flood Insurance Program Reauthorization Act (SAFE NFIP) 2017." After a brief review, let's look at what is new and improved in SAFE NFIP.

Background

My first six blogs, beginning in January 2013, have covered legislative efforts to primarily refund the National Flood Insurance Program (NFIP) which, despite these efforts remains approximately $25B in debt. A quick recap of these six blogs is:

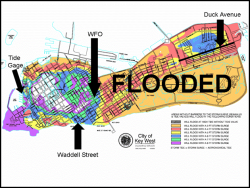

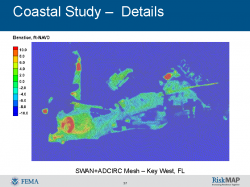

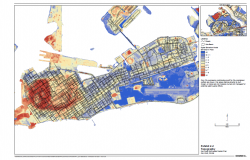

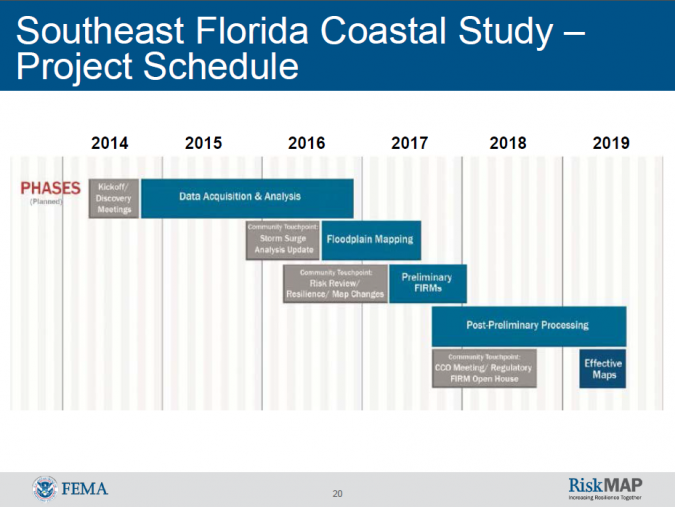

- Is your Flood Insurance Going Up - Part VI (June 2016) - An update of the FEMA RiskMap mapping project begun in 2013.

- Is Your Flood Insurance Going Up - Part V (July 2014) - Details of the FEMA mapping effort for the Keys and South Florida including an extensive Outreach Program.

- Is Your Flood Insurance Going Up - Part IV (March 2014) - A recap of the March 2014 Homeowners Flood Insurance Affordability Act (HFIAA).

- Is Your Flood Insurance Going Up - Part III (October 2013) - Realization by politicians, including a co-author of flood insurance legislation called the Biggerts Waters Insurance Reform Act of 2012 (BW-12), that BW-12 was causing the consumer more harm than good, aka "unintended consequences".

- Is Your Flood Insurance Going Up - Part II (September 2013) - Treatment of historic buildings, second homes, businesses and no more exemptions under BW-12.

- Is Your Flood Insurance Going Up - Part I (January 2013) - Flood insurance rate changes and their justifications according to BW-12; i.e., refund the bankrupt NFIP.

Today's Truth

You can view the 24 minute video of the June 13 news conference on the City of Key West web page or click on this link.

Additionally, critical information regarding Flood Insurance and related issues can be found by reviewing the comments of the City's FEMA/CRS Cordinatorand Floodplain Administrator, Scott Fraser at http://www.cityofkeywest-fl.gov/Flood.

This Flood web site contains a host of links to flood mapping, FEMA elevation certificates and the 50% rule for Substantial Improvement.

Key Points in the SAFE NFIP proposal.

Section 102: Cap All Premium Rate Hikes at 10%

- Prohibits FEMA from increasing premium rates above 10% per year on any policy holder for 6 years.

Section 103: Means Tested Mitigation and Affordability Assistance

- Requires FEMA to offer zero or low-interest loans to fund mitigation projects by homeowners, like elevation and flood-proofing

- Requires FEMA to provide financial assistance to offset any NFIP premiums and/or mitigation loan payments that cause housing costs to exceed 30 percent of household’s Adjusted Gross Income (AGI). (Note: Not sure of the components of AGI)

Section 104: Coverage Expansion

- Increases policy coverage limits to $500,000 for residences and $1,500,000 for multifamily and business structures to insure the fair market value of the building.

Section 105: Small Business Interruption Insurance

- Requires FEMA to conduct a study on offering business interruption coverage in the NFIP policy.

Triple the max Cost of Compliance payment to $100,000

Section 201: Increased Cost of Compliance Expansion

Increased Cost of Compliance (ICC) is an insurance product, coupled to the flood policy, that offsets costs incurred to bring a structure up to the standards in community land use regulations and building codes. SAFE NFIP increases the amount available and expands the use of ICC for pre-disaster upgrades for the most vulnerable properties; specifically,

- Increases the maximum ICC payment from $30,000 to $100,000

- Expands eligibility to any repetitive loss properties in and outside SFHA

- Continues eligibility for a building that is substantially damaged

- At the discretion of the Administrator, ICC can be awarded to a multiple loss property, that does not meet the definition of repetitive loss

- Adds ICC coverage to all NFIP Policies, in and out of the SFHA (Like X-Flood Zone properties)

- Covers elevators, ramps, or other devices or alternations necessary for a homeowner or current occupant to safely access a home that has been elevated based on physical limitations or disabilities

Section 202: Flood Mitigation Assistance

- Authorizes $1 billion to be appropriated to fund the FMA and require FEMA to prioritize properties that have suffered repetitive losses and have unaffordable premiums.

Section 203: Pre-Disaster Hazard Mitigation Grant Program Authorization

- The Pre-Disaster Mitigation (PDM) program is critical in retrofitting structures to reduce future vulnerability and to pay for updates to state and local Hazard Mitigation Plans. Authorizes $500 million per year for 6 years for PDM.

Section 204: LiDAR Mapping Authorization

- Provide a $500 credit to the policy holder to obtain an elevation certificate

Section 206: Multifamily Mitigation

- FEMA is conducting a study on ways that multifamily buildings can be retrofitted to minimize flood damage. When consistent with building codes, allows premium credit for alternative or partial mitigation measures for multifamily buildings in urban areas where standard mitigation measures like elevation, is unfeasible. (Note: Reclassify multifamily as commercial property with associated floodproofing measures.)

Section 301: Forbearance on NFIP Interest Payments

- Freezes interest accrual on the NFIP’s debt to the Treasury for 6 years after enactment

Section 302: Cap WYO Compensation

- Policyholders should not overpay WYO companies that sell policies and service claims but have no risk exposure. WYO compensation capped at 22.46% of written premiums, while maintaining agent commission at 15% of written premiums. (Note: Just let the private sector compete for best rates).

Section 303: Taxpayer Protection

- Requires FEMA to develop a fee schedule based on actual costs it incurs to develop and maintain its Flood Insurance Rate Map (FIRM) and charge any private entity an appropriate fee for use of such map. (Note: Really?)

The process of filing, processing and payig for an appeal has moved from favoring FEMA to favoring the policy holder.

Section 401: Earth Movement and Pre-existing Conditions Clarification

- Earth movement resulting from flooding shall not be used as an exclusion to making a claim

Section 403: Mold Damage Clarification

- Damage from mold is generally covered if caused by flood. Failure to inspect and maintain the property after a flood recedes must be interpreted with what can reasonably be expected from a survivor in the aftermath of the particular storm.

Section 404: Extend Deadline to File Appeal

- Requires the Administrator to establish an appeals process

- Extends the deadline for a policyholder to appeal his or her claim determination to FEMA to 1 year after the determination was made

Section 405: Enforce Deadline for FEMA to Respond to Appeal

- Requires FEMA to respond to a claims appeals within 90 days. FEMA must adjudicate an appeal within 90 days or award the appellant the full amount of his or her appeal if FEMA does not comply with the deadline.

Section 406: Optional Arbitration for Appeal

- Requires FEMA to establish a process to allow policyholder to request his or her appeal be heard through independent, binding arbitration rather than through FEMA.

Section 407: Accountability for Improper Underpayments by WYOs

- Requires FEMA to require WYOs to pay FEMA the amount the WYO underpaid or overpays a policyholder.

Section 408: Policyholder Right to Know

- Gives policyholders the right to access to all documents used in processing a claim within 7 days of the request, free of charge

- Requires notice to policyholders within 30 days of making a claim that claim-related documents are available upon request.

Section 409: Increase Statute of Limitations for Lawsuits

- Increases the statute of limitations for policyholders to file a lawsuit challenging their flood insurance claim to 2 years after a determination is made.

Section 410: Attorney Fee Shifting

- Institutes fee-shifting, whereby a policyholder, when prevailing in an administrative appeal process or in litigation, is entitled to receive attorney’s fees and expert fees.

Section 411: DOJ Defense Against Policyholder Lawsuits

- FEMA will refer policyholder lawsuits, including those against the WYO, to the Department of Justice. DOJ, working as necessary with FEMA counsel,will defend these cases. Under no circumstances shall DOJ seek to throw out lawsuits with potential meritorious claims because of good faith errors or omissions by the policyholder in the policyholder’s proof of loss.

Section 412: Study on Participation Rates

- Requires FEMA within 1 year of bill enactment to submit a report to Congress indicating the percentage of properties with federally backed mortgages that have flood insurance within the Special Flood Hazard Area and 500-year floodplain. (Note: Florida is one of the few states that requires and monitors that mortgage backed properties in flood zones have flood insurance, meaning that often, mortgage backed properties in flood zones without flood insurance outside of Florida file claims and receive disaster assistance despite not having contributed to NFIP. This report may help to end this practice).

Section 413: Authority to Terminate Contractors and Vendors

- Provides FEMA with additional authority to terminate contractors and vendors that have exhibited detrimental conduct.

Section 414: Easing Proof of Loss Requirements

- Clarifies that any honest errors or omissions by the policyholder must simply be pointed out to the policyholder for revision and not used to deny the policyholder a claim, or the right to appeal or to litigate

Section 415: Elevation Certificates

- Establishes that the Elevation Certificate and its surveyed elevation data will have no expiration date, provided there have been no alterations to the structure and no alteration to the topography surrounding the perimeter of the building.

Section 416: Monthly Installments of Premiums

- Encourages FEMA to expedite the implementation of the monthly installment payment of premiums

Section 417: Pre-existing Structural Conditions pilot program

- Authorizes FEMA to create a pilot program that allows WYO companies, at the request of policyholders prior to insurance coverage or renewal, the ability to inspect and document preexisting structural conditions of insured properties and potentially insured properties, to memorialize the conditions of the structure prior to a claim to inform on the cause of the loss.

Section 419: Engineer Certification

- Requires engineers to be licensed in the state where services are performed on behalf of the NFIP

- Requires an individual retained to perform engineering services in connection with assessing any claim of loss covered by a Standard Flood Insurance Policy (SFIP) to also be certified by FEMA via initial training and annual renewal of certification through continuing education.

Section 420: Engineer Report Manipulation

- Prohibits an engineering report from being modified or manipulated by anyone who has not sealed the report.

Section 424: Improved Disclosure Requirements

- Requires landlords to disclose to tenants the flood zone classification of the property, whether the property is covered by flood insurance, and the availability of contents coverage from the NFIP.

Conclusion

The NFIP strategy has shifted from paying claims to preparing properties to be less flood-prone, obligating FEMA to process claims quicker and with less red-tape, getting rid of the sharks through training and certification and providing for better FEMA staff at the local level.

Fortunately, our local FEMA staff is well on the ball, allowing Key West to effectively participate and benefit from the Community Rating System (CRS).

Again, well done to all the folks at the State Office of Floodplain Management and to our own Scot Fraser in Key West.

In you have any comments or questions, please contact me here.

Good luck!